Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--USD/ZAR Forex Signal: US Dollar Pulls Back Against South African Ran

- 【XM Group】--USD/JPY Analysis: Surges to 2-Month High

- 【XM Market Review】--GBP/USD Analysis: Performance portends a strong move ahead

- 【XM Market Review】--EUR/USD Forex Signal: Targets 1.0250 Ahead of ECB Decision

- 【XM Forex】--Gold Analysis: Returning to a Downward Channel

market analysis

Gold is above 3508, continue to watch the trend rise and break high

Wonderful Introduction:

Love sometimes does not require the promise of vows, but she must need meticulous care and greetings; sometimes she does not need the tragic spirit of Liang Zhu turning into a butterfly, but she must need the tacit understanding and www.xmniubi.companionship with each other; sometimes she does not need the follower of male and female followers, but she must need the support and understanding of each other.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Decision Analysis]: Gold is above 3508, continue to watch the trend rise and break the high." Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: Gold is above 3508, continue to watch the trend rise and break the high

Review yesterday's market trend and technical points:

First, in terms of gold: Yesterday's Asian session continued to rise by 30 meters in the morning, and then it fell back to the top and bottom support 3488 in the afternoon, which happened to be the 618 segment support point to continue to try to be bullish, and the hourly line The big sun rises at 3477 as a defense, but unfortunately, the European market surged and fell back. A small washout came, piercing the morning rise point and falling to the 3470 line; then the European market was weak, but the trend was still unilateral long, and it was predicted that the US market bottomed out first and continued to be bullish. As a result, the US market waited for a long time and did not suppress it again, and the research report plan failed to retrace the bullish point. After slowly hovering around the mid-range of the hourly line for five hours, it rose again in the middle of the night. The side pulls up and hits the 3540 line height; this also shows that this round of unilateral trend is very strong, and the principle of only long and not short is maintained;

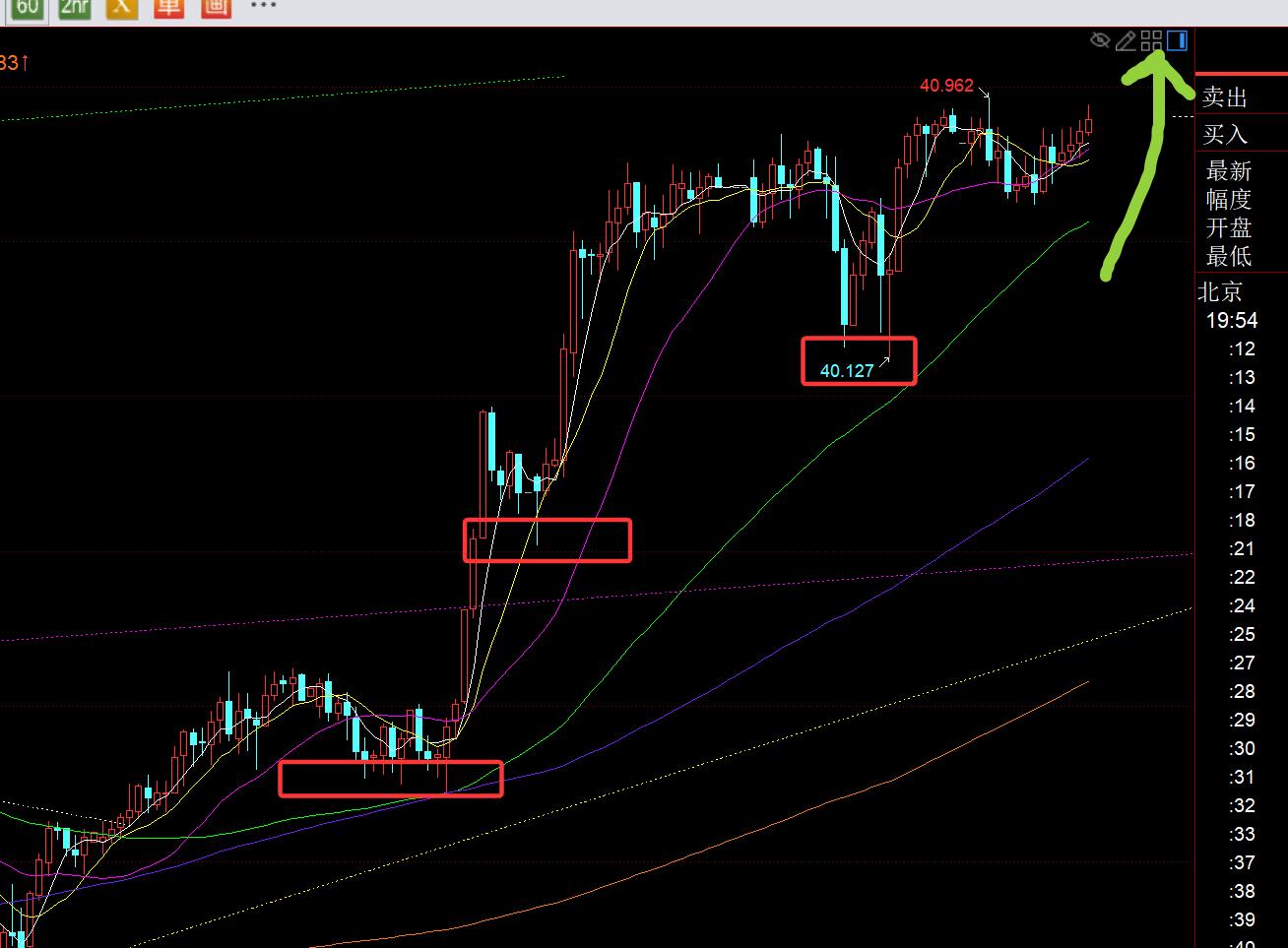

Second, silver: The research report points out that it continues to be bullish at 40.2-40, and finally meets the prediction, and successfully pulls up to the 40.9 line;

Third, crude oil: Yesterday, the European market rose continuously, and the US market planned to fall back and rebound bullish again, but found that it fluctuates back and forth, which is difficult to continue, and the rebound prompts to keep the capital and adjust the position and leave;

Today's market analysis and interpretation:

First, gold daily line level: yesterday closed positive again, and it was a big positive K, which has been continuously positive for six consecutive times, which is perfectly in line with the unilateral trend bullish morphology characteristics. The higher the price, you will find that the stronger the trend, the more difficult it will fall, and the less you can give your ideal entry point; of course, from the perspective of historical trend pattern laws,Generally, after the maximum nine consecutive positives, it is easy to have a negative retracement to make short-term corrections, and then continue to develop continuously; when the price gradually leaves the short-term moving average, you must always be careful of sudden decline and corrections. If you cannot enter the ideal low, then wait patiently for it to have a pullback opportunity before intervening in the low long. As long as you have multiple bottom positions in the previous period, you will be more low-level, even if you don’t add positions in the past two days, it is quite www.xmniubi.comfortable to watch the continuous rapid surge in position profits. This is why the 4-month oscillation in the previous period must be continuously tried to speculate in the short-term bottom. The reason is that in the later stage, they can basically lay flat; and many people think that the initial period is constantly being organized within the range of 3400-3300, and always think that the trend will peak and will plummet, so they will naturally not be able to bottom out. When the price is higher, they will only look for resistance and shortness, and will not follow up with the trend. At this time, they continue to hit historical highs, which has www.xmniubi.completely subverted their cognition, and the rhythm and mentality will basically be messed up; they may finally know the strength of the trend bulls, but they will never dare to take long positions at high levels, because there is no low-level bottom position in their hands, but they will always worry about when the sudden big drop will suddenly fall. , do not admit failure, this subconscious thinking revolves around them every day, so in the end they still choose to push up and try to make short. As a result, they continue to pull up and try to make short every day, and they are constantly beaten by the market until they explode.

Today's 5 moving average support moves upward above 3480, which is 70 meters away from the price at this time. Once the distance is larger, close to 100 meters or higher, you must always be careful to rise and fall to quickly correct it. Of course, this does not mean that you can go against the trend and short. As a unilateral strong trend, remember to only have more The principle of non-empty remains unchanged. Give up the pullback. Any idea of grabbing the pullback will basically be beaten at both ends. At this time, the 3550 mark is approaching, and the risk of chasing longs will gradually increase. Just wait patiently for it to fall and stabilize and continue to bullish. As long as it maintains the short term for 5 days and the limit is 10 days, keep the trend one-sided bullish all the way;

Second, gold 4-hour level: pay attention to the 10 moving average 3517 line tonight, run at this position, and continue to maintain a strong short squeeze and pull up;

Third, gold hourly line level: strongly pulling up overnight, and the cycle continues to rise in the morning today. Unlike yesterday, the European session did not fall back, but resisted the decline all the way. Then the originally planned bullish level 382 split the support 3817, and the top and bottom support 3808 is basically unavailable for the time being; because in a unilateral trend, sideways trading is also a strong performance. At this time, the US market has strengthened again before the market, and it will continue to be bullish tonight. The primary support is the mid-track of this cycle, currently moving up to 3532 line, and the second is the low of 3525 line today. Holding 3525-3532 is the strong bullish one-sided. If you accidentally lose the intraday low, you will move down to support 3508. The lower track and top and bottom support in the figure are as long as you stabilize it, it will continue to stabilize on lows and continue to bullish. The target resistance will be closed first.Note 3555, and then up is 3575;

In terms of silver: the low point gradually moves upward, the high point gradually breaks upward, and it is also continuing to be bullish; today, as long as you keep yesterday's low point 40.1, use it as a defense, and continue to fall back and fall back, the daily 5 moving average support moves upward by 40.2-40.3, and continue to be bullish at this position, with targets 41, 41.7, etc.;

In terms of crude oil: it really has no splashes, it is just a fluctuation. Now gold and silver are in a unilateral long trend, so naturally they should be the main focus; tonight, pay attention to 64 support and 65.7 resistance, and look at the gains and losses of the range;

The above are several views of the author's technical analysis, as a reference, and it is also the focus of more than 12 hours a day for twelve years. The technical experience accumulated in the market and review will be disclosed every day, and the technical points will be explained in conjunction with text and video interpretation. Friends who want to learn can www.xmniubi.compare and refer to them based on actual trends; those who recognize ideas can refer to operations, lead defense well, and risk control first; those who do not agree should just be drifted by; thank everyone for their support and attention;

[The article views are for reference only. Investment is risky. You must be cautious, rationally operate, strictly set losses, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng's Dianyin

Watch the market for more than 12 hours a day, persist for ten years, and detailed technical interpretation will be disclosed on the entire network, serving the whole network with sincerity, sincerity, perseverance and wholeheartedness! www.xmniubi.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Foreign Exchange Decision Analysis]: Gold is above 3508, continue to watch the trend rise and break the high". It was carefully www.xmniubi.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here