Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

market news

The U.S. job vacancy weakens + bond market volatility slows down, and the pound rebounds to catch a breath! The US dollar range is coming to an end

Wonderful Introduction:

Only by setting off can you reach your ideals and destinations, only by working hard can you achieve brilliant success, and only by sowing can you gain. Only by pursuing can one taste a dignified person.

Hello everyone, today XM Forex will bring you "[XM official website]: US job vacancy weakens + bond market volatility slows down, the pound rebounds to catch a breath! The US dollar range fluctuates toward the end." Hope it will be helpful to you! The original content is as follows:

Asian market market

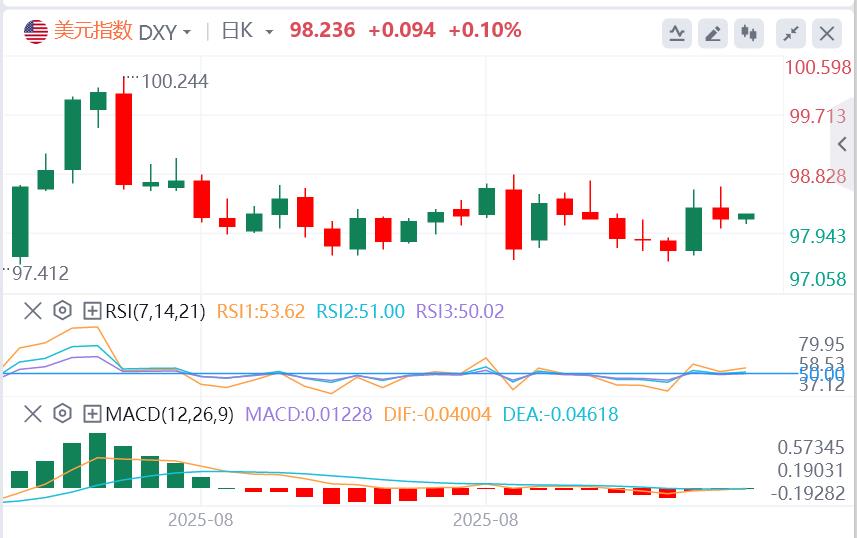

On Wednesday, the US dollar index fluctuated above the 98 mark. The US market fell sharply due to career vacancy data showing weak recruitment of enterprises. As of now, the US dollar price is 98.23.

1. Fed

① Waller: I believe we should cut interest rates at the next meeting. There may be multiple interest rate cuts in the future, but the specific pace depends on the data.

②Musalem: The current interest rate is just right, but the employment market is risky.

③Bostic: I am worried about inflation and still think it is appropriate to cut interest rates once this year.

④The Federal Reserve will hold a payment innovation meeting on October 21, which will discuss stablecoins, artificial intelligence and tokenization.

⑤Federal Director Nominee Milan: If the nomination is confirmed, it will maintain FOMC independence.

⑥ Kashkali: There is still room for a moderate reduction in interest rates.

⑦Federal Beige Book: Economic activities remain basically the same, and businesses and households feel the impact of tariffs.

2. Tariffs

① Trump plans to impose tariffs on countries that regulate U.S. technology www.xmniubi.companies, and sources say the main target of the threat is South Korea rather than Europe.

②Indian Trade Minister: Hope to reach a bilateral trade agreement with the United States by November.

③The Canadian Prime Minister said the dialogue with Trump was "good" but tariffs will remain, and the former said he had sent special envoys to the United States.

3. US July JOLTs JobsThe number of vacancy unexpectedly dropped from 7.36 million downward correction in June to 7.18 million, with an expected 7.378 million, the lowest level in 10 months.

4. EU Trade www.xmniubi.commissioner Sevkovic: He will continue to contact the United States to strive for more tariff exemptions.

5. Trump hinted that he would impose phases of oil sanctions on Russia. The United States hopes that Europe will stop buying Russian oil and join its proposed sanctions against countries that continue to buy Russian oil.

6. The World Gold Council seeks to launch digital gold to create new models for precious metal trading, settlement and mortgage.

7. Israeli officials claim that the U.S. Secretary of State privately expressed no opposition to Israel's annexation of the West Bank, and the United States would not obstruct it.

Summary of institutional views

Westminster National Bank looks forward to the US non-agricultural non-agricultural non-agricultural non-agricultural non-agricultural non-agricultural report in August: If the data is... it will be enough to support the Federal Reserve's interest rate cut this month

There is a lot of economic data this week and the economic calendar is relatively busy due to a long weekend holiday, but the focus is undoubtedly the US non-agricultural non-agricultural report released on Friday. We expect non-farm employment to continue to grow moderately, or record 65,000, of which 55,000 were in the private sector, while the unemployment rate will rise slightly to 4.3%. And the employment report will be released before the start of the silent period of the Federal Reserve's September meeting. If the actual published data meets our expectations, it will be sufficient to support the FOMC's decision to cut interest rates by 25 basis points at the September meeting. In addition, we expect the US ISM service industry PMI to expand further in August.

Natixis: Non-farm population may continue to be weak in August, and the unemployment rate may rise to...

We expect the U.S. non-farm population to increase by 54,000 in August, slightly lower than the July data. This expectation reflects both a decline in labor demand and a slowdown in population growth (partially due to a decrease in immigration inflows). In addition, the three-month moving average of non-farm employment growth has dropped from 232,000 in January to 35,000. Especially after the July non-farm report was released, the market was difficult to be optimistic about the performance of the US labor market. First of all, the overall data in a single month was lower than market expectations, and secondly, the correction to the previous value was huge. And employment growth is concentrated in a single industry (private education and health services), while 6 out of 14 industries have shrunk. The core focus of the report is a sharp downward revision of employment data in May and June (total reduction of 258,000 people), which coincides with uncertainty in trade/immigration/fiscal policy at the time and reflects more on weak corporate recruitment intentions than concerns about the economic outlook.

We believe that the U.S. non-farm report in August will show that employment growth will continue to be concentrated in a few industries, with all growth in the past three months contributed by the private education and health services sector. Policymakers will pay more attention to the unemployment rate, given the high uncertainty of the rate of employment growth that matches population growth due to slowing immigration. We believe that the reduction in labor force and the decline in immigration inflow will lead to a gradual unemployment rate.Non-fast rise. The slowdown in the growth rate of initial unemployment benefits confirms this trend, with the unemployment rate expected to rise slightly to 4.3%.

Danske Bank: The U.S. inflation risk is on the rise, and the eurozone’s fight against inflation may be over.

Despite uncertainties related to the trade war, global manufacturing still shows signs of momentum improvement in the near future. The downward trend in the global manufacturing cycle has lasted for three years, and the recovery has been repeatedly delayed. In August, the eurozone manufacturing industry achieved growth for the first time since June 2022, and the US manufacturing PMI also rose from 49.8 to 53.0.

As the service industry remains in the expansion range, major economies appear to be moving towards near structural growth rates. Although the eurozone growth may slow down in the second half of this year due to the reversal of the early consumption effect, it will regain momentum next year. On the United States, fiscal tightening caused by raising tariffs will restrict growth this year, but it is expected that the pre-effect of the "package of stimulus bills" will boost the economy during the winter.

The changes in the U.S. inflation outlook puts the Federal Reserve in a dilemma, and the pressure on interest rate cuts at the political level has also intensified recently. In principle, tariffs will only trigger temporary price fluctuations, but multiple indicators show that longer-lasting price pressures may be brewing: the continued rise in inflation expectations has prompted retailers and wholesalers to implement pre-emptive price increases. Coupled with fiscal stimulus measures next year, U.S. inflation risks tend to rise.

In contrast, in the euro zone, it can be said that the battle against inflation has ended. In fact, overall inflation is likely to be significantly lower than the ECB’s 2% target early next year. However, the ECB does not seem to be concerned about this, and we adjusted our forecast for the ECB this summer, given the decline in trade policy uncertainty and the greater macroeconomic performance. We believe the ECB has ended its rate cut cycle and expects deposit rates to remain at 2% during our forecast period.

The above content is all about "[XM official website]: US job vacancy weakens + bond market volatility slows down, the pound rebounds to catch a breath! The US dollar range fluctuations are www.xmniubi.coming to an end". It is carefully www.xmniubi.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here