Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--EUR/USD Forecast: Faces Key Test

- 【XM Decision Analysis】--GBP/USD Analysis: Nearing Oversold Levels

- 【XM Market Review】--AUD/USD Forex Signal: Rangebound Ahead of US Jobs Data

- 【XM Group】--USD/JPY Analysis: Bullish Flag Formation

- 【XM Decision Analysis】--EUR/USD Analysis: Downward Trend Strong

market analysis

Expectations of interest rate cuts in September are solid! The US dollar is testing key support again. Will non-farmers end the bulls and bears tug-of-war this week?

Wonderful introduction:

A clean and honest man is the happiness of honest people, a prosperous business is the happiness of businessmen, a punishment of evil and traitors is the happiness of chivalrous men, a good character and academic performance is the happiness of students, aiding the poor and helping the poor is the happiness of good people, and planting in spring and harvesting in autumn is the happiness of farmers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: The expectation of interest rate cuts in September is solid! The US dollar will test key support again. Will non-farmers end the bulls and bears tug-of-war this week?" Hope it will be helpful to you! The original content is as follows:

Asian market market

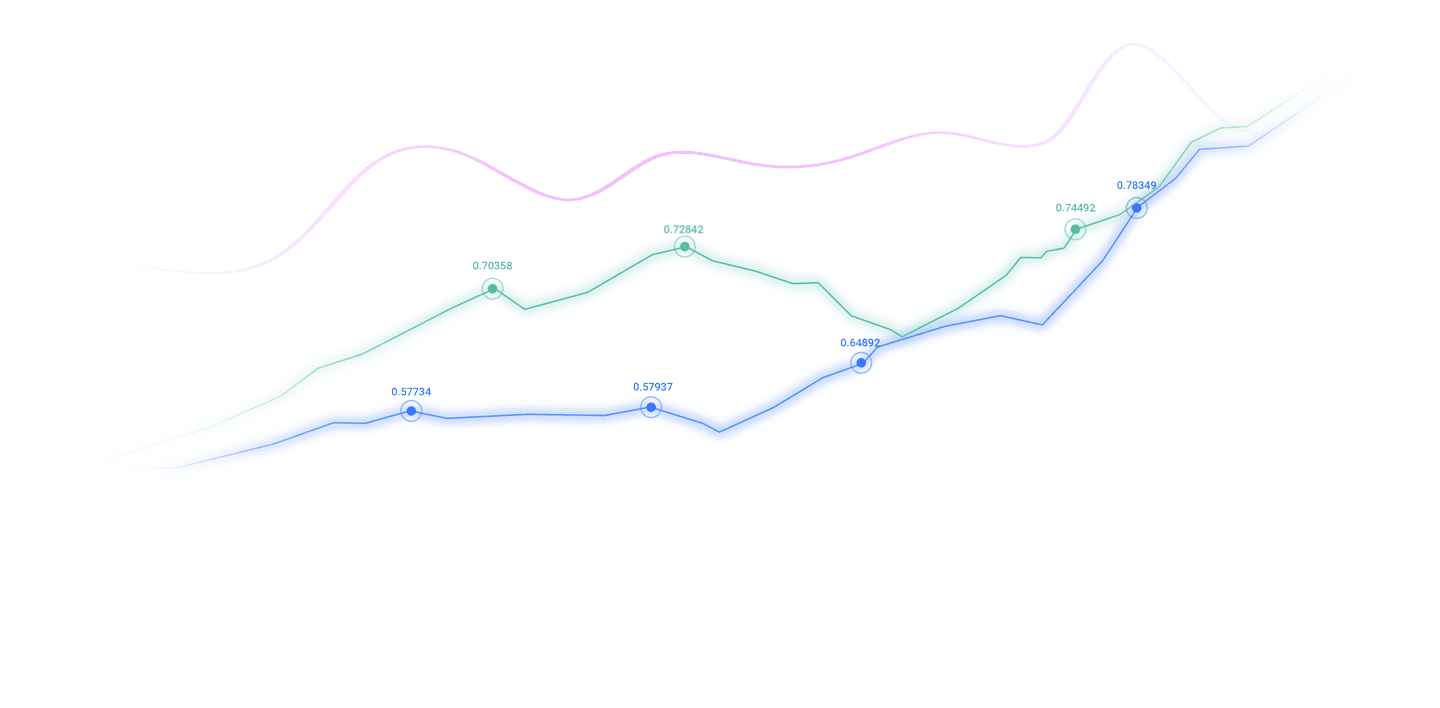

Last Friday, since the US inflation data basically met expectations, strengthened the expectation that the Federal Reserve may cut interest rates next month. The US dollar index rose first and then fell. As of now, the US dollar price is 97.71.

1. The Federal Circuit Court of Appeals ruled that Trump's tariff measures were illegal. Trump called it "wrong" and stressed that the relevant tax is still in effect.

2. Fed

① A US judge did not make a ruling in court on Trump's removal of Cook, which means that the interest rate decision maker will remain in office for the time being.

②Federal Daly hints at a rate cut in September, saying there is tension in the dual targets.

③ The annual rate of the core PCE price index in the United States in July was 2.9%, the highest since February 2025, in line with expectations. Traders continue to bet on the Fed's interest rate cut in September.

④ The Federal Reserve finalizes the new capital requirements of the major bank, and Morgan Stanley applies for reconsideration.

3. In terms of the situation in Russia and Ukraine

① Zelensky: Ukraine plans to launch a new round of in-depth strikes on Russia. On August 29, Russia and Ukraine had fierce battles in the important city of Donetsk.

②Zelensky and European leaders are reported to meet with Trump this week, and Zelensky hopes that security guarantees are legally binding.

③ President of the European www.xmniubi.commission: The EU has clear plans to send troops to Ukraine.

④DeFrance seeks to impose secondary sanctions on Russian supporters, which will provide additional air defense to Ukraine during the Russian attack.

4. In the situation in the Middle East

① Many senior officials died in Israeli air strikes, and the Houthi armed forces in Yemen are preparing to confront Israel. US media: Houthi forces raided UN food and children's institutions in Yemen.

②The Minister of Justice said that the Israeli army had killed Abu Ubaida, spokesman for Hamaskasan Brigade. ③Foreign media: Israel is reportedly considering annexation of the West Bank.

④ Israeli military: The preliminary operation and initial stage of attack on Gaza City has begun.

⑤ Türkiye has decided to www.xmniubi.completely cut off economic and www.xmniubi.commercial ties with Israel and close airspace to its aircraft.

5. US Administration and Budget Bureau (OMB): Trump canceled nearly $5 billion in foreign aid.

Summary of institutional views

Goldman Sachs analysts Sven JariStehn and AlexandreStott: Will the strong euro further cut interest rates? Goldman Sachs believes...

Although the euro has weakened recently, the significant appreciation of the euro has sparked a debate within the ECB about the potential impact of inflation and monetary policy since the beginning of the year. Some ECB officials expressed concerns about the strengthening of the euro, but some believe that this mainly reflects an improvement in the European economic outlook and is therefore not enough to support further rate cuts.

Our analysis shows that the key to affecting inflation is the "magnitude of change" of the euro rather than the "absolute level", and that the trade-weighted euro (up about 5% since January) has a greater impact on inflation than the euro/dollar exchange rate (up about 11%). Furthermore, we found that when exchange rate changes reflect “exogenous” factors that are not related to the euro zone economy, their impact on inflation is more significant. But we estimate that about two-thirds of the trade-weighted euro appreciation since the beginning of this year are due to market expectations that Germany's fiscal expansion drives demand, and only one-third www.xmniubi.comes from exogenous factors.

Our estimates suggest that if the euro strengthens further, it may prompt more rate cuts, but the extent will mainly depend on the source of appreciation and its intensity. Goldman Sachs Forex strategists expect that the trade-weighted euro will appreciate by about 2.5% and 6% in the next six months and 12 months respectively. If half of them are exogenous factors (more than about one-third of the proportion in the first half of the year), it may mean that policy interest rates will fall by about 11 basis points in the next six months and about 26 basis points in the next 12 months.

So, overall, the current strength of the euro is not enough to be a strong reason for further interest rate cuts unless the euro appreciates significantly in the future due to non-European economic improvement factors. In response, we expect the ECB to maintain its current 2% interest rate unchanged unless the economic outlook worsens.

Financial Times columnist Katie Martin: Trump's intervention in the Fed approaches his limit, waiting for the bond market's charity police to create "April glory” (I)

When will the financial market tell Trump that his intervention in the Federal Reserve has reached the red line? We may be closer than many people think. Trump tried to remove Fed Director Cook, but in the United States, the market seemed to be relaxed. People pay much attention to Nvidia's latest financial report far exceeds this currency operation. The dollar has remained quite stable, and the stock market has been rising all week, but if you look closely, you will see a little sign of tension in the bond market.

The market once again sent Trump this message: "Sir, hold on! Anyway, we like low interest rates! Investors give different explanations for this. Optimists believe that these things are not important at all, that the Fed’s structure will remain the same, or that Trump’s efforts to reshape the Fed will fail. Another explanation is that if the bond market really resists, the Fed will be able to formulate countermeasures, such as plans to buy U.S. Treasury bonds in the last week or so. This shows that investors are becoming increasingly more stressful. Convinced that the United States will cut interest rates in a fairly short time, but in the future, inflation may be a persistent concern, especially if a politicized central bank keeps interest rates below the level it should be maintained in order to please an intervention-loving president.

Financial Times columnist Katie Martin: Trump's intervention in the Fed is approaching its limit, waiting for the bond market police to recreate "April glory" (II)

Long-term bonds are precisely where any market resistance will appear. The tentative schedule for the upcoming bond auction of the U.S. Treasury Department only includes short-term bonds in the www.xmniubi.coming week or so, Long-term bonds will hit the market in early September. The key question is whether buyers will retreat. Recall that weak demand for long-term bonds in April this year seems to be the reason why the Trump administration has made concessions on trade tariffs. For usually reliable bond buyers, leaving now is not without risk. Refusing to buy U.S. Treasury bonds, or just agreeing to buy at much lower prices, could annoy Trump. But this time the bond market may revolt. If investors let it go, they shouldn't be surprised if there are more weird policies in the future. Without market resistance, it's hard to imagine how this will stop. Appeared.

Dan Tobon, head of foreign exchange strategy at Citigroup G10: Believe in data or the Fed? The foreign exchange market already has a choice

Trump's Fed chairman candidate Waller said he hopes to cut interest rates starting next month and "fully expect" more rate cuts to bring policy rates closer to neutral levels. The foreign exchange market is still in range volatility, and investors are waiting for the next U.S. jobs report released on September 5. Interestingly, the foreign exchange market's response to the policy speech and the Fed's related dynamics is relatively mild - which may be due to the lack of liquidity in the summerIt may also be because the market expects that any adjustments from the Federal Reserve will trigger a cycle similar to a fully digested rate cut. This further confirms our point of view – everything will depend on the data.

The above content is all about "[XM Forex]: The expectation of interest rate cuts in September is stable! The US dollar will test key support again. Will non-agricultural farmers end the long-short tug-of-war this week?", which was carefully www.xmniubi.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here