Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--Nasdaq Forecast: Holding Support

- 【XM Market Review】--AUD/USD Forecast: Holds in Consolidation

- 【XM Market Analysis】--USD/SGD Forecast: Will the Uptrend Continue?

- 【XM Group】--EUR/USD Forex Signal: Brief Pullback Likely Ahead of Fed

- 【XM Forex】--USD/MYR Analysis: Faces Resistance Near 4.4580

market analysis

Gold was in place yesterday at 3575, and it is a good thing to dive and adjust today, so it will continue to be bullish.

Wonderful introduction:

A clean and honest man is the happiness of honest people, a prosperous business is the happiness of businessmen, a punishment of evil and traitors is the happiness of chivalrous men, a good character and academic performance is the happiness of students, aiding the poor and helping the poor is the happiness of good people, and planting in spring and harvesting in autumn is the happiness of farmers.

Hello everyone, today XM Forex will bring you "[XM Group]: Gold was in place yesterday at 3575, and it is a good thing to dive and adjust today, and it will continue to be bullish." Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: Gold was in place yesterday at 3575, and it is a good thing to dive and adjust today, and it will continue to be bullish.

Review yesterday's market trend and technical points:

First, in terms of gold: Yesterday's morning, it is planned to be bullish, and the price continues to rise, with a minimum of 3525, with a slightly different position. The European session continues to be narrow, and the plan is to wait close to the hourly line. The middle track has stabilized, and it will continue to be bullish. After waiting for a long time, it has not been able to reach the middle track. Before the US market, the continuous positive trend broke the intraday high. The evening research report pointed out that the bullish trend can be tried in advance at 3532-28, but it still does not give opportunities. It directly rises slowly and rises continuously, and finally reaches the expected targets of 3555 and 3575;

Second, silver: Yesterday's plan was to continue to be bullish, with a minimum of only 40.6, the target It is successfully above 41;

Today's market analysis and interpretation:

First, gold daily line level: Yesterday, it continued to close positively, and it has been seven consecutive positively. The closer it is to nine consecutive positively, the more you will be worried about the diving correction at any time, and you want to wait for a pullback to continue bullish, but the trend is to remain strong and not fall, which was the case yesterday; but what should www.xmniubi.come will still www.xmniubi.come. Today, the Asian session saw a sharp drop, touching the 3510 line at the lowest point. It is better to reach the 5 moving average; as a strong unilateral pull-up, when the negative is first released, it is often treated as a single negative, and it is easy to continue to close the positive next day; therefore, as long as you keep the 5 moving average above 3510 today, you will continue to maintain the unilateral bullish unchanged, and it will be difficult to lose the 3500 mark for the time being; to announce small non-agricultural areas tonight, it will imply the announcement of large non-agricultural areas tomorrow. This year, the announcement of large and small non-agricultural areas is almost a world of difference. If it is small non-agricultural areas, the employment data of small non-agricultural areas has increased significantly, the big non-agricultural economy has been significantly reduced; otherwise, the same; so this can be used as a reference. If you want the big non-agricultural outbreak tomorrow night, it is best to publish relatively explosive data tonight. Generally, the stimulus of small non-agricultural areas is not very strong, so even if the list is out, it may only fall briefly and then gradually rebound;

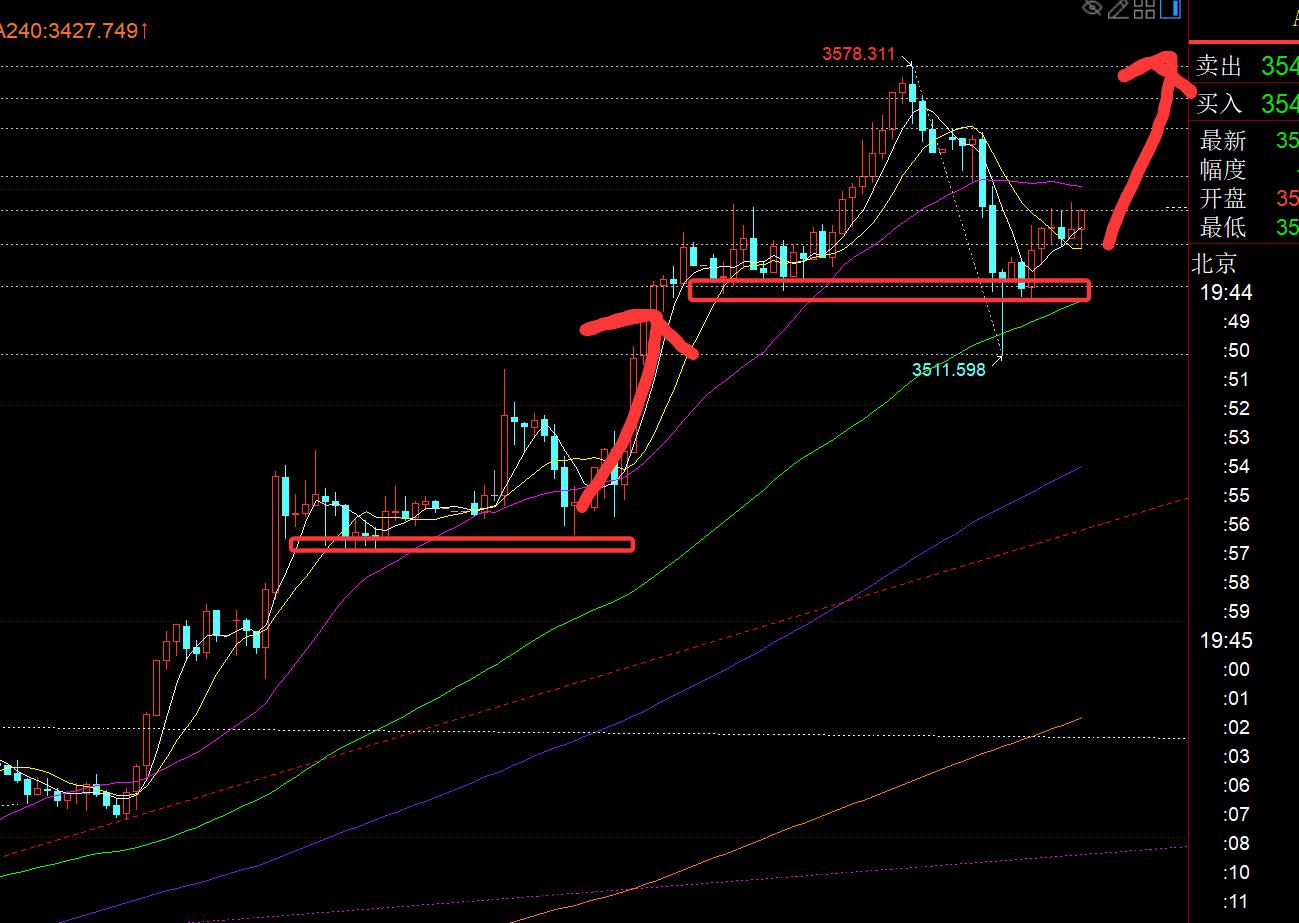

Second, gold has a few transactions in 4 hours: the clouds have been lost in the short term for 5 days and 10 days during the day, but the lows have stabilized above the middle track; as long as the fall is still holding the middle track tonight, it will continue to be bullish. Once it stands on the short-term moving average again, it will continue to strengthen and move forward to the previous high;

Third, golden hourly line level: There was no similar rise and pull-up in the first two times this morning, but a sharp dive occurred. It was originally expected that it would happen on Friday, ahead of today; the lowest hit to the 3511 line, this position happened to be the 618 segment position of 3470-3578 retracement. We know that in the big trend, 618 is a relatively critical point, which determines the short-term strength and weakness changes; after the European session stabilized the 618 position, it fluctuated and rebounded all the way, reaching the 50 segment resistance of 3311-3578, and the important short-term pressure level is 618, which happens to be the middle track, that is, 3551-52. If you break through tonight and stand on it again, you can continue to follow The rise will basically hit the intraday high and continue to strengthen. In that way, the daily line will close again and impact the 3600 mark; on the contrary, if the resistance to 3551-3552 is under pressure tonight, there may be a second decline. At that time, pay attention to the stabilization of 3524-25 and 3511, and continue to be bullish; of course, there is another situation, that is, the wide fluctuation between 3510-3578, and it is difficult to continue up and down, and wait for the non-agricultural farm to decide the next short-term direction tomorrow night; no matter what, continue to maintain the trend bullish, and there will be short-term adjustments in advance today, and a big rock falls in my heart. No matter what, I will no longer worry about the diving adjustment at the same time. Cherish the low level that I set today. This may be the starting point for the next daily line to continue positive;

Silver: There was also a plunge pullback in the Asian session today, which just pointed to the daily 5 moving average, and there were signs of stabilization; from the above chart, the low point is still gradually rising, and there are certain double bottoms in the 40.6 line. As a unilateral trend pulling up, the double bottom is also a good stable signal; at the same time, the hourly line mid-track 41 is also a key short-term resistance tonight. Once it breaks through to the 41, the retracement confirms stability and continues to follow the bullishness, hitting the 41.45 height, and even breaking up; on the contrary, if the pressure is down, continue to pay attention to the 40.6 line support stabilization and bullishness;

In terms of crude oil: at the daily level, it is difficult to continue with large or large negative crude oil, and the overall fluctuation is around range; yesterday closed with large negative, but today may not be able to continue well. The hourly line macd is in a bottom divergence state, and it is easy to rebound after pulling down. Tonight, pay attention to the 63.6 channel counterpressure. Once it breaks through the station, it will return to the channel and look back to the upper track; or breaks a new low again, and then continues to diverge and stabilize and look at the rebound. It is best to effectively stand on the hourly line 10 moving average, then turn back to confirm and look at the rebound. It is still in a certain slow decline, wait;

The above are several views analyzed by the author, as a reference, and it is also the market for more than 12 hours a day, for more than 12 hours a day The accumulated technical experience points are disclosed every day, and the text and video interpretations are interpreted. Friends who want to learn can www.xmniubi.compare and refer to them based on actual trends; those who recognize ideas can refer to them, lead defense well, and risk control first; those who do not agree should just be over; thank everyone for their support and attention;

[The article views are for reference only. Investment is risky. You must be cautious in entering the market, operate rationally, strictly set losses, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng's Dianyin

A study on the market for more than 12 hours a day, persist for ten years, and detailed technical interpretations are disclosed on the entire network, serving the whole network with sincerity, sincerity, perseverance and wholeheartedness! www.xmniubi.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Group]: Gold was in place yesterday, 3575 was in place, and today's diving adjustment is a good thing, continue to be bullish". It was carefully www.xmniubi.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and it stays in my heart forever. Leave~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here