Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--AUD/USD Forex Signal: Crashes as US and Australia Bond Yields Rise

- 【XM Group】--WTI Crude Oil Monthly Forecast: December 2024

- 【XM Decision Analysis】--GBP/USD Forex Signal: Possible Bearish Double Top at $1.

- 【XM Decision Analysis】--USD/CHF Forecast: Holds Ground at Crucial Support

- 【XM Group】--USD/CAD Forecast: Pulls Back Amid Holiday Quiet

market news

Gold's early trading lows become the key, and European and American ranges are treated

Wonderful introduction:

Without the depth of the blue sky, there can be the elegance of white clouds; without the magnificence of the sea, there can be the elegance of the stream; without the fragrance of the wilderness, there can be the emerald green of the grass. There is no seat for bystanders in life, we can always find our own position, our own light source, and our own voice.

Hello everyone, today XM Foreign Exchange will bring you "【XM Group】: The gains and losses of gold's early trading lows become the key, and the European and American ranges are treated fluctuatingly." Hope it will be helpful to you! The original content is as follows:

Dollar Index

In terms of the performance of the US dollar index, the US dollar index showed a downward trend on Wednesday. The price of the US dollar index rose to 98.611 at the highest, and fell to 97.985 at the lowest, and finally closed at 98.123. Looking back at the market performance on Wednesday, the price rose continuously in the short term during the early trading session, and then again under pressure after breaking through the previous day's high. Finally, the price fell back to the weekly daily line and the four-hour support area. Although the daily line ended, the US dollar index has bottomed out recently. It is recommended to continue holding it for yesterday's layout. At the same time, ADP and non-agricultural data will be released today and tomorrow, so everyone should pay attention to risks in operation.

From a multi-cycle analysis, the weekly level has recently been the key consolidation of the weekly line. Currently, the weekly line resistance is in the 98 area, and the price breaks upward again on Tuesday. Yesterday, the price continued to fall back. At this point, it continues to treat more according to the oscillation and the medium-term line. From the daily level, we need to pay attention to the 98.10 regional support for the time being, so as long as the current price does not close, it will continue to be more biased than the daily and weekly support. We will temporarily pay attention to the 98.25 area in four hours, and will continue after standing firmly. There are also many in one hour now, and the focus above is on the 98.60-99 area.

The US dollar index has a long range of 98.00-10, with a defense of 5 US dollars, and a target of 98.60-99

Gold

In terms of gold, the overall gold price on Wednesday showedIn an upward state, the price rose to the highest level of 3578.34 on the day, fell to the lowest level of 3526.17 on the spot, and closed at 3558.98 on the spot. In response to the early trading period of Wednesday, gold prices were still corrected in the early trading and hit a new high. After that, the European market fluctuated and rose, the US continued to accelerate after the trading session, and finally the big sun ended. The price of today's morning session showed a rapid correction, and the position touched the four-hour support area, so the gains and losses of the early trading low became the key. If you don't break, you will continue to treat it more. Only after the break is broken will you make adjustments.

From a multi-cycle analysis, first observe the monthly rhythm. The monthly price ended in August. Overall, the price is still running bullishly. From the long-term perspective, the 3000 position is the watershed of the long-term trend. The price can be treated more on the long-term. From the weekly level, the price has broken through key resistance after recent continuous fluctuations and has now hit a new historical high. Currently, the weekly long and short watershed is at 3370. The price is above this position and the medium line is treated more. From the daily level, we need to pay attention to the 3416 regional support for the time being, and the band above this position should be treated more frequently. From the four-hour perspective, gold did not retrace back four-hour support yesterday, but instead retraceeded in the morning today. Therefore, the early low point has now become a watershed for gold's short-term trend. It is still too high before it breaks down, and it is expected to adjust after breaking down. Now, it is more and less moving today, and wait for the US market to follow the layout. ADP data will be released today, and there will be non-agricultural products tomorrow, so you must pay attention to market risks in the last two days of the week.

Gold pays attention to the gains and losses of the 3510-3511 range. The gains and losses of this position determine whether the majority can continue

Europe and the United States

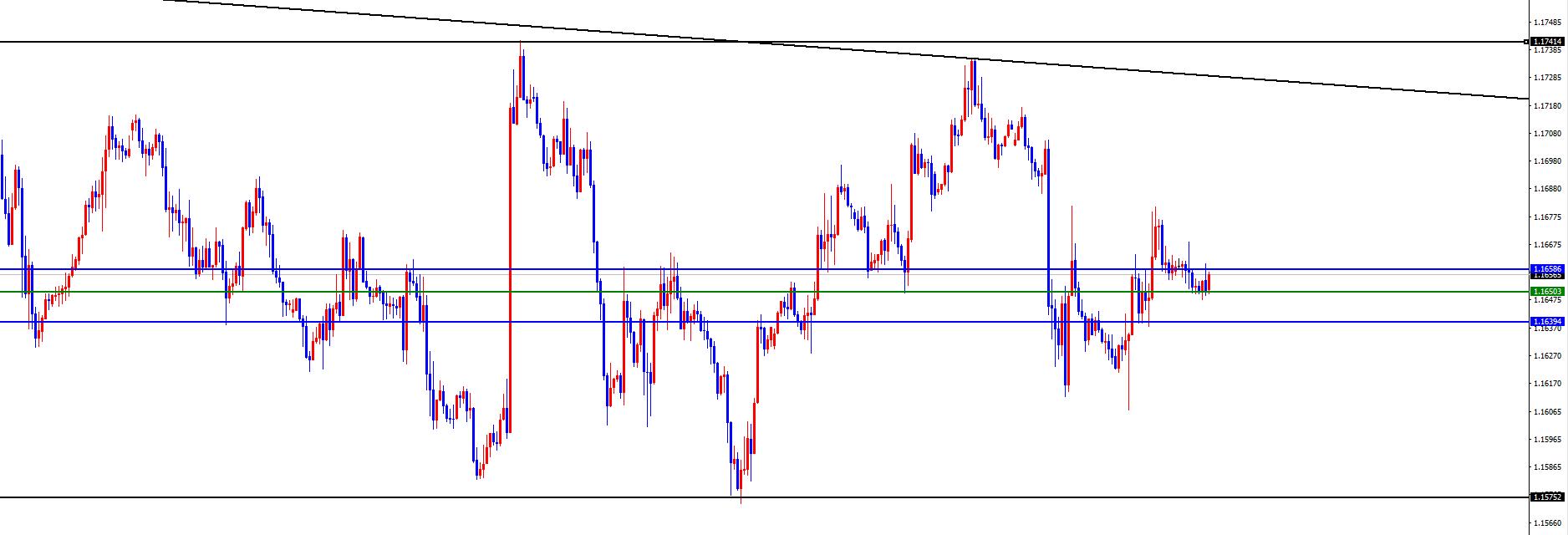

Europe and the United States, the prices of Europe and the United States overall showed an upward trend on Wednesday. The price fell to 1.1607 on the day and rose to 1.1681 on the spot and closed at 1.1660 on the spot. Looking back at the performance of European and American markets on Wednesday, prices in the early trading first remained downward, and then bottomed out and rebounded in the European trading. Then the price tested the four-hour resistance area and adjusted to fluctuate, and finally the big sun ended on the day. In response to the same sharp fluctuations in Europe and the United States today, we need to pay attention to the continuation after the break.

From a multi-cycle analysis, from the monthly level, Europe and the United States are supported by 1.1060, so the price is treated with long-term bulls above this position. From the weekly level, the price is supported by the 1.1640 area. This position is the long-shoulder watershed in the mid-line trend, and the subsequent focus is on the weekly closing performance. From the daily level, the current daily resistance is at 1.1658 as time goes by. This position is a key watershed in the band trend, and the price continues to fluctuate in this area. In addition, overall, the price remains at the 1.1575-1.1740 range, and we need to pay attention to the continued after the breaking range. From the four-hour level, the current price is currently supported at 1.1650 for four hours, and it also tends to oscillate in four hours. In addition, ADP data will be welcomed today, so it is close to today's conservatives.The upper edge of the range is under pressure.

Europe and the United States are concerned about the 1.1575-1.1740 range, and the middle watershed is 1.1640-60 range

[Finance data and events that are focused on today] Thursday, September 4, 2025

①14:30 Swiss August CPI monthly rate

②15:00 Swiss August seasonally adjusted unemployment rate

③17:00 Monthly rate of retail sales in the euro zone in July

④19:30 Number of layoffs for challenger www.xmniubi.companies in the United States in August

⑤20:15 Number of U.S. ADP employment in August

⑥20:30 Number of initial unemployment claims in the week from the United States to August 30

⑦20:30 US trade account in July

⑧21:45 US S&P Global Services Industry PMI final value in August

⑨22:00 US August ISM Non-Manufacturing PMI

⑩22:00 US Senate www.xmniubi.committee holds a hearing on the nomination of Fed directors

22:30 US to August 29 EIA natural gas inventory

23:30 US to August 29

23:30 US to speech at the New York Economic Club

The next day 00:00 US to 8 EIA crude oil inventories on the week of the 29th of the month

The next day was 00:00 to the US to August 29th of the week

The next day was 00:00 to the US to August 29th of the week

The next day was 00:00 to the US to August 29th of the week

Note: The above is only personal opinions and strategies, for review and www.xmniubi.communication only, and does not give customers any investment advice. It has nothing to do with customers' investment, and is not used as a basis for placing an order.

The above content is all about "【XM Group】: Gold's early trading lows become the key, and European and American ranges are treated with volatile treatment". It is carefully www.xmniubi.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Life in the present, don’t waste your current life in missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here