Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--AUD/CAD Forecast: Can the Australian Dollar Continue to Fight the Ca

- 【XM Group】--BTC/USD Forecast: Volatility in Consolidation - What Will Make It Mo

- 【XM Market Review】--Silver Forecast: Silver Sits at a Significant Trendline

- 【XM Forex】--GBP/USD Forecast: Tests Key Resistance at 1.27

- 【XM Market Analysis】--Weekly Forex Forecast – Bitcoin, EUR/USD, NZD/USD, USD/CAD

market news

Gold successfully hits a record high again, and continues to maintain the trend bullish

Wonderful Introduction:

A quiet path will always arouse a relaxed yearning in twists and turns; a huge wave, the thrilling sound can be even more stacked when the tide rises and falls; a story, only with regrets and sorrows can bring about a heart-wrenching desolation; a life, where the ups and downs show the stunning heroism.

Hello everyone, today XM Forex will bring you "[XM Official Website]: Gold successfully hits a new historical high, and continues to maintain the trend bullish." Hope it will be helpful to you! The original content is as follows:

Zheng's silver spot: Gold successfully hits a new historical high, and continues to maintain a bullish trend

Review yesterday's market trend and technical points:

First, gold: When August closed with a full big positive K, swallowing up the long upper shadow of the previous few months and the daily line effectively breaks through the upper convergence triangle that has been on the 4-month upper track, and the continuous positive breakthrough and pulling up means gold returns If the bull market is bull market, if a wave of trend rises unilaterally, it is predicted that it will be a matter of time before the 3500 record high; yesterday morning, the first-tier 3437 fell back and stabilized and rose sharply to 3485, and in the afternoon, the 3472 fell back and stabilized and rose to 3490. The European market stabilized 3467 and the US market 3476 both prompted the bullish level, and today it successfully reached the 3500 mark. As long as one of the waves is caught, it is good; as a unilateral pull-up market, , as long as you see a strong resistance to decline and sideways at a high level, it is a correction method of time and space exchange, and it will still rise in the end;

Second, silver: the weekend video gave a back-retracement of 39.5 and 39.35 in advance, and can continue to be bullish. Yesterday morning, it fell to 39.5 and stabilized, and it attacked 1 unilaterally to the 40.6 line, and directly won 1 yuan a day, which is equivalent to a rise of 50 US dollars in gold;

Third, crude oil In the past few days, we have been observing the www.xmniubi.competition between the mid-track of the daily line and the 10 moving average. If we break through, we will follow the side, which side will we follow. Obviously, we tend to break up, and then we will look at a wave of continuous rebound;

Today's market analysis and interpretation:

First, gold daily line level: Yesterday, it continued to rely on the 5 moving average to close positive, and it has been continuously positive for five consecutive positives. As a one-sided rising market, the most www.xmniubi.common trend is the continuous positive single-yin mode. The more days of continuous positive, the stronger the trend.Strength; and if there is the first yin one day, then it is used as a short-term correction, and it will close again in the next day, with a maximum of two days of cloudy, and will continue to maintain the 5-day limit, and the extreme 10-day moving average is developing upward; yesterday also mentioned that if the current price gradually moves away from the short-term moving average, it will occasionally surge and fall back to wait for the moving average to move upward, and during the waiting process, the appearance of high yin and yang K is the best repair pattern, then It will continue to maintain a slow rise pattern all the way, and boil the frog in warm water and attack one-sidedly; as long as there is no super large sun K acceleration for two or three consecutive days, it will not reach a peak in the short term; in fact, it cannot be said that it will reach a peak, it should be said that the decline will fall with a slightly larger amplitude correction; the second half of this year will only hit historical highs repeatedly, and the price will only rise higher and higher. Don’t always guess what you call peak. In the early stage, you think about breaking 3200, breaking 3000, and in the near future, you will see it. It may not be possible to break through and stand firm immediately at the 3500 mark for a while, and it is normal to fluctuate at a high level, or wash it a little during the day, but the market will basically rise to 3500 many times until it is taken down and stand firm at 3500, and then it will make further efforts. When you look back at the end of the year, 3500 is actually a low level; continue to keep the trend bullish, believe in the trend, and don’t underestimate the charm of the trend;

Second, gold 4-hour level: a big negative backtest appeared at the 18-point closing line, swallowing up the big positive entity in the morning, but it has temporarily only pierced the 10 moving average and has not yet fallen effectively. At this time, it starts to close the positive upward attack again. Once the 22-point closing line and re-stand the 5 moving average, it will strengthen again; on the contrary, if it surges and falls, then it will be a good low bullish point near the middle track; stay bullish and wait for the signal to stabilize;

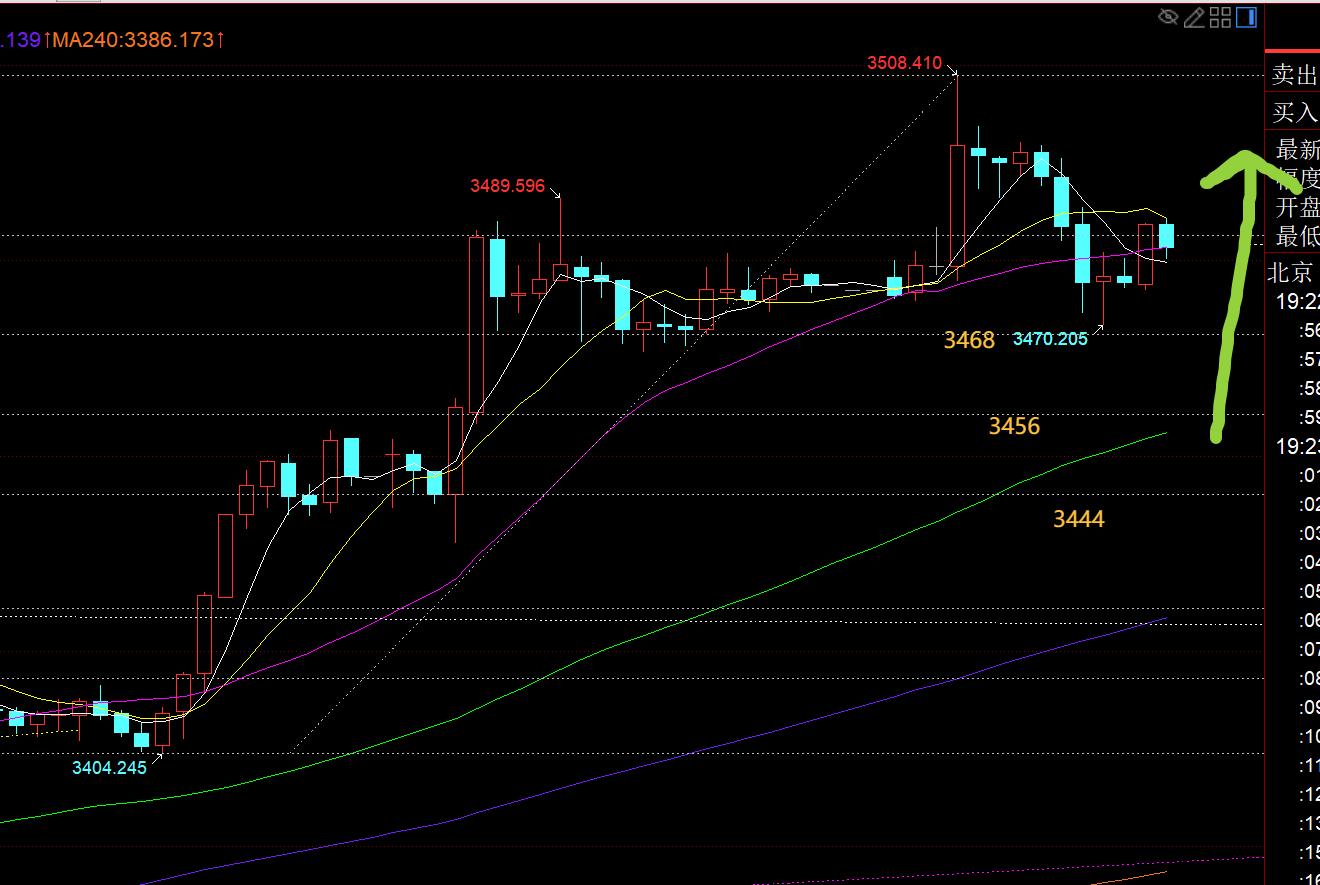

Third, the golden hourly line level: The Asian session finally broke the cycle in the morning. Every day after the Asian session opens in the past two weeks, it is easy to fall first. Today, it is directly lifted 30 meters, hitting a record high, and the inertia is more than 8 meters, with a maximum of 3508; in the afternoon, the sideways above 3390, the European session is downward, which is considered a wave of washing, because it pierces the morning low point, the hourly line's big positive starting point, etc. As long as it follows the bullish short-term, it will basically lose, but what I want to say is that during the unilateral pull-up process, there will be no strong attacks in a straight line, and there will always be a high-level diving pullback. It is unclear when it jumps, for example, today The afternoon jump is because of the British fiscal crisis. The pound plunged sharply in the short term, pushing the US dollar to rise sharply in an instant, thus suppressing the gold price; but have you found that the US dollar has been rising all the way, and gold has not actually fallen much, because the US dollar and gold are both safe haven ports, and the United States itself also has a debt crisis. Will there be a chain reaction? The ultimate perfect safe haven is gold; return to technology, since the European session has surged and fell, the US session may also have a wave of downward slump and then stabilized and rose again, and it is also possible to take the opportunity to repair the short-term divergence and overbought. It is best to use a long-term oscillation to run as a correction, and wait until it approaches the daily 5 moving average (up 34 today44) It will be a new starting point for pulling up. Of course, it is still a certain distance from it now, and it may not be www.xmniubi.completely tested; from the perspective of segmentation, we must first focus on the first-line support of 3468 tonight, followed by 3456, strong support 3444. Each support may stabilize at any time and pull up again to 3500, especially the latter two;

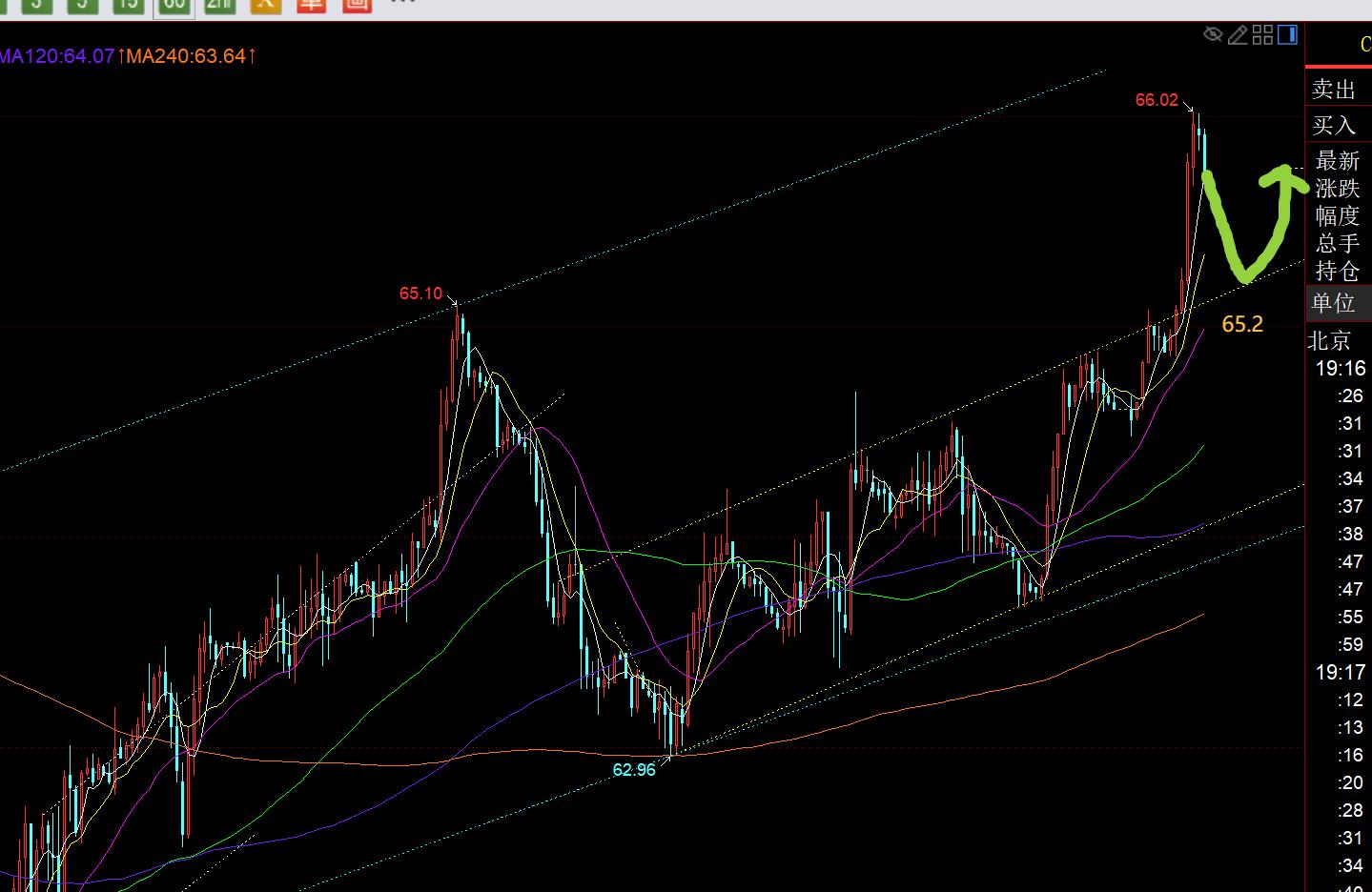

Silver: The daily line was very positive yesterday, breaking through the upper track of the channel, and today's retracement confirmed support is 40.2 line; in addition, from the above chart, the European market also surged and fell back. At this time, the US market rebounded before and after, you should be careful to lure the bulls. Observe first. The 66-day moving average support below should have support; therefore, pay attention to the stabilization of 40.2-40 and continue to be bullish, with the resistance target of 40.8-41;

In terms of crude oil: the daily line closed positively yesterday and broke through the middle track first, which tends to continue to rebound upward; today's European session continued to break the highs, and the US session looked at the second pull-up, pay attention to the yellow channel retracement confirming support of 65.2, stabilizing and bullish;

The above are several points of the author's technical analysis. As a reference, it is also a summary of the technical experience accumulated by the market for more than 12 hours a day in the past twelve years. Technical points will be disclosed every day, and text and video interpretations. Friends who want to learn can www.xmniubi.compare them based on the actual trend. Reference; those who recognize ideas can refer to the operation, lead the defense well, risk control first; those who do not recognize them should just be floating by; thank you for your support and attention;

[The article views are for reference only. Investment is risky. You must be cautious when entering the market, operate rationally, set losses strictly, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng's Dianyin

A study on the market for more than 12 hours a day, persist for ten years, and detailed technical interpretations are made public on the entire network, serving the whole network with sincerity, sincerity, perseverance and wholeheartedness! www.xmniubi.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM official website]: Gold successfully hits a record high again, continues to maintain a bullish trend". It was carefully www.xmniubi.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Step up to learn the next article!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here