Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Forex】--AUD/USD Forex Signal: Aussie Crash to Continue as Inflation Falls

- 【XM Forex】--USD/CAD Forecast: Volatile Day

- 【XM Group】--USD/ILS Analysis: Long-Term Depths Challenged and Lower Trading Rang

- 【XM Group】--USD/JPY Forecast: US Dollar Continues to Pummel Japanese Yen

- 【XM Decision Analysis】--EUR/USD Analysis: Temporary Halt in Losses

market news

Silver breaks through $40 for the first time in fourteen years, Fed rate cuts boost gold prices

Wonderful introduction:

Optimism is the line of egrets that are straight up to the blue sky, optimism is the ten thousand white sails beside the sunken boat, optimism is the lush grass that blows with the wind on the head of the parrot island, optimism is the falling red spots that turn into spring mud to protect the flowers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: Silver broke through $40 for the first time in fourteen years, and the Federal Reserve's interest rate cut bets boosted, and gold prices are only $10 away from the historical high." Hope it will be helpful to you! The original content is as follows:

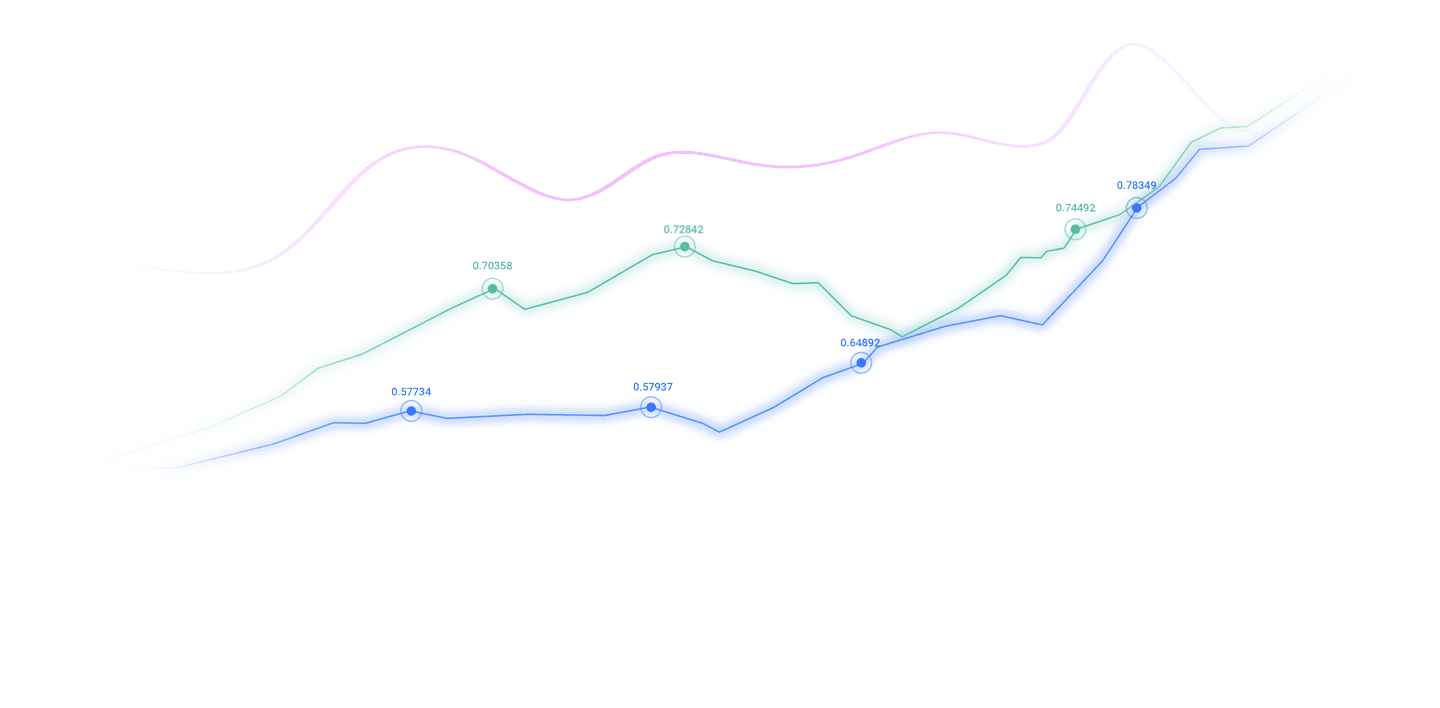

Basic news

On Tuesday (September 2 Beijing time), spot gold trading was around $3,480/ounce, and gold prices hit a four-month high of $3,489.78/ounce on Monday, just $10 away from the April high. Boosted by the Federal Reserve's interest rate cut bets and the weakening of the US dollar, silver prices also exceeded $40 per ounce for the first time since 2011; U.S. crude oil trading was around $64.57/barrel, as the market was concerned that intensified air strikes in Russia and Ukraine could lead to supply disruptions, and the weakening of the US dollar provided additional support for oil prices.

Gold market

Gold prices hit a more than four-month high of $3,489.78 per ounce on Monday, boosted by the Federal Reserve's bets on interest rate cuts and a weaker dollar; silver prices broke through $40 per ounce for the first time since 2011.

Spot gold was $3477.56 per ounce, up 0.9%, the highest level since hitting a record high of $3500.05 on April 22. U.S. gold futures for December delivery rose 0.9% to $3,547.70. Spot silver jumped 2.6% to $40.69 an ounce, a new high since September 2011. The U.S. market was closed on Monday due to Labor Day holiday. The US dollar index is close to its lowest point since July 28.

Ole Hansen, head of www.xmniubi.commodities strategy at Saxo Bank, said: "Gold, especially silver, continued its strong gains on Friday, mainly supported by factors such as continued rise in U.S. inflation, weak consumer sentiment, (expected) rate cuts and concerns about the independence of the Federal Reserve."

Data released last Friday showed that the U.S. PCE price index was relatively highThe previous month rose 0.2%, and the year-on-year growth was 2.6%, in line with expectations. Silver is rising due to expectations of interest rate cuts, while tight supply markets also help maintain the upward trend of silver, said Tim Waterer, chief market analyst at KCMTrade.

San Francisco Fed Chairman Mary Daly posted on social media last week, reiterating his support for the rate cut on labor market risks.

UBS analyst Giovanni Staunovo said: "The market is focusing on Friday's U.S. jobs report, which will support investment demand, is expected to allow the Fed to resume interest rate cuts from September."

The survey shows that non-farm jobs in August, which will be announced on Friday, is expected to increase by 78,000, www.xmniubi.compared with 73,000 in July. Platinum rose 3.2% to $1,408.54; palladium rose 1.9% to $1,129.70.

Oil market

Oil prices rose on Monday, with Brent crude closing up 1% on Monday, with settlement price at $68.15 per barrel, and U.S. crude oil rose 1.1% to $64.68 per barrel as markets feared that intensified air strikes in Russia and Ukraine could lead to supply disruptions, while weakening the dollar provided additional support for oil prices.

Affected by the US Labor Day holiday, U.S. crude oil futures will not settle on Monday. And due to the US holiday, Brent crude oil and U.S. crude oil traded lightly.

Traffic tracking data cited by ANZ analysts showed that weekly oil transport volumes at Russian ports fell to a four-week low of 2.72 million barrels per day, and markets remain concerned about Russia's oil supply.

The U.S. labor market report, which will be released this week, will reflect its economic health and test investors' confidence in an upcoming rate cut. The dollar hit a five-week low on Monday before the data was released.

Investors are also paying attention to the OPEC+ meeting to be held on September 7.

Foreign Market

The dollar hit a five-week low on Monday, as investors awaited a series of U.S. job market data for the week that could impact expectations of the Federal Reserve's monetary policy path. Traders are also evaluating U.S. inflation data and court rulings that most of Trump’s tariffs are illegal, and his wrestling with the Fed over his attempt to fire Fed Director Cook.

According to the CMEFedWatch tool, the money market recently expects the Federal Reserve to cut interest rates by 25 basis points in September and a 100 basis points rate cut by the fall of 2026 is about 90%.

The US dollar index fell 0.17%, to a low of 97.52, the lowest level since July 28. Investors will focus on Friday's U.S. non-farm employment report, ahead of which there are job openings and private sector employment data.

Analysts say the U.S. economy is no longer as good as it has been for most of the past decade, providing reasons for a weaker dollar, and further signs of weaker job markets are expected to support thisOne statement.

Social Bank analyst Klaus Baader said a severe weakness would mean the Fed would respond more strongly than market forecasts, but if the May/June weakness is seen as a statistical illusion, then given the prospect of rising inflation around the next year is almost certain, a rate cut seems unnecessary," some analysts still believe that the Fed may cut interest rates by 50 basis points later this month.

The euro rose 0.25% to close at $1.1710; the pound rose 0.31% to close at $1.3542. The U.S. market closed on Monday due to holidays.

Politics The governance of risks has become the focus of market attention, and the French government may face failure in a vote of confidence on a plan to cut the budget in an all-round way. Analysts point out that the euro will only be under pressure when such risks show signs of spreading within the euro zone, which is not obvious at the moment.

As the United States continues to negotiate with major trading partners, investors are also paying close attention to trade policy. We believe the court ruling will not have much impact on the market and the matter will be handed over to the Supreme Court, which is likely to make a ruling in favor of Trump as Trump step up efforts Exercising greater influence on monetary policy, concerns about the independence of the Federal Reserve have also dragged down the dollar.

International News

Bestert: Several candidates for the Federal Reserve Chairman are also expected to be directors

U.S. Treasury Secretary Scott Besent told Semafor on Monday that the “several” candidates for the Fed’s chairman are also candidates to fill two vacant seats in the central bank’s board of directors. When asked about the market’s reaction to President Trump’s attempt to remove Fed Director Cook, Besent said both the bond market and the foreign exchange market remained “calm.” Besent said he and Trump had “discussed in detail what the candidates should be and their qualifications”. Beisen said Trump “has great respect” to the Fed.

Becent said Trump may declare a U.S. housing emergency this fall

U.S. Treasury Secretary Scott Beisen said in an interview with Washington Examiner on Monday that the Trump administration may declare a national housing emergency in the fall. Beisen also hinted that authorities are looking at how to regulate local building and zoning codes and reduce transaction www.xmniubi.completion costs, and that Trump may also consider imposing tariff exemptions on specific building materials. Beisen said, "We are working hard to figure out what we can do, and we don't want to interfere in state, county and city affairs." ”

Trump said India proposed to lower tariffs on the US to zero but it was too late

U.S. President Trump said that India had proposed to cut tariff rates after the United States imposed a 50% tariff on India for buying Russian oil last week. “They have now proposed to lower tariffs to zero, but it is too late. They should be countingIt was done a year ago," Trump posted on social platform TruthSocial on Monday. It is not clear when India will propose it, nor whether the White House plans to restart trade talks with India.

The French Prime Minister admits: consultations this week may fail

French Prime Minister François Belu said that the vote of confidence that will be held in a week is about the fate of France. The vote is likely to lead to the ouster of its government. "The problem is not the fate of the prime minister, nor the fate of François Belu," he said in an interview with four French news channels last Sunday. "It is not even the fate of the government." The problem is France's fate. ”

The British Prime Minister promoted the Chancellor's deputy to the chief secretary of his office, hoping to strengthen control of economic policies

British Prime Minister Stamer announced a series of personnel adjustments to his Downing Street team. Darren Jones, deputy of Chancellor Rachel Reeves, was appointed as the prime minister's chief secretary, responsible for the daily operation of his office - will become one of the highest-level members of the Stamer government. Insiders said such adjustments will make the Prime Minister's Office work closer together with the Chancellor of the Chancellor. Stamer hopes to take the opportunity to "re-remain The government has been questioned in the past year after entering Downing Street (Prime Minister's Office), and the Labor Party's approval rating has dropped significantly.

Media: The U.S. government is preparing to take new measures against Brazil

According to www.xmniubi.comN Brasil, people familiar with Washington, the U.S. government is considering taking measures against Brazilian banks and Brazil's import of diesel from Russia. According to one of the sources, the closest sanctions appear to be against Brazilian banks, adding that the background of the action is against former Brazilian president Jair Bolsonaro The trial began on September 2. According to sources in Washington, it is expected that the U.S. government will also take trade measures against Brazil's import of diesel from Russia, and it will be implemented within a week or a half.

The EU responded to the pressure from the US to continue to implement digital-related legislation

The European www.xmniubi.commission's executive vice president for technical sovereignty and other matters said on social media on the 1st that the Digital Services Act and the Digital Market Act are the EU's "sovereign legislation" and the EU will continue to implement these digital laws. Vilkunin said that the relevant digital laws are non-discriminatory and appropriate Used for all online platforms operating in the EU.

Domestic News

Ministry of Industry and Information Technology: Actively participate in global governance in the fields of digital economy, artificial intelligence, etc.

On September 1, the Party Group of the Ministry of Industry and Information Technology carried out a study of the theoretical study center group. The meeting emphasized that open sharing is the inherent meaning of promoting new industrialization. We must unswervingly expand high-level opening up to the outside world, make good use of the two domestic and international markets and two resources, promote the mutual promotion of domestic and international dual circulations, and cultivate my country's new advantages in participating in international cooperation and www.xmniubi.competition. We must "bring in" with higher quality and build market-oriented,A first-class business environment with a rule of law and internationalization encourages foreign-invested enterprises to deeply participate in the new industrialization process. We must "go global" at a higher level, encourage enterprises to diversify their layout and international development, and deepen cooperation with countries in jointly building the "Belt and Road" for www.xmniubi.complementary industrial advantages. We must actively participate in global governance in the digital economy, artificial intelligence, radio spectrum, www.xmniubi.communication infrastructure and other fields, promote the construction of a new industrial revolution partnership network, and promote the construction of a safe, stable, smooth, efficient, open, inclusive, and mutually beneficial and win-win global industrial chain and supply chain system.

In the first half of the year, overseas investors held A-shares with a market value of over 3 trillion yuan

UBS Securities China Stock Strategy Analyst Meng Lei mentioned that overseas funds showed a net inflow of A-shares in the first half of 2025. As of the end of June 2025, overseas investors held A-share market value of 3.07 trillion yuan. It is estimated that northbound funds increased their holdings of A-shares in the first two quarters of 2025, and the total net inflow of northbound A-shares in the first half of the year reached 83.6 billion yuan.

The above content is all about "[XM Forex Official Website]: Silver broke through $40 for the first time in 14 years, and the Federal Reserve's interest rate cut bets boosted, and gold prices are only 10 dollars away from the historical high." It is carefully www.xmniubi.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here