Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--AUD/USD Forecast: Struggles Against Stronger USD

- 【XM Market Analysis】--BTC/USD Forex Signal: Bullish Pennant Points to a Bullish

- 【XM Forex】--USD/MYR Analysis: Shifting Sentiment and a Speculative Elevated Rang

- 【XM Market Review】--AUD/USD Forex Signal: Range Continues

- 【XM Forex】--USD/JPY Forecast: US Dollar Bounces Around Against the Yen on Tuesda

market news

The US dollar index may face sharp fluctuations this week

Wonderful Introduction:

Love sometimes does not require the promise of vows, but she must need meticulous care and greetings; sometimes she does not need the tragic spirit of Liang Zhu turning into a butterfly, but she must need the tacit understanding and www.xmniubi.companionship with each other; sometimes she does not need the follower of male and female followers, but she must need the support and understanding of each other.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: Big Non-agricultural Superimposed Beige Book, the US dollar index may fluctuate violently this week." Hope it will be helpful to you! The original content is as follows:

XM foreign exchange market prospect: Big non-agricultural plus brown paper, the US dollar index may face sharp fluctuations this week

XM forward: The importance of economic data to be released this week from high to low is: the US August non-agricultural employment report, euro zone CPI data, Federal Reserve Beige Book, and the speech of European Central Bank Governor Lagarde. Next, the interpretation will be made one by one.

▲XM chart

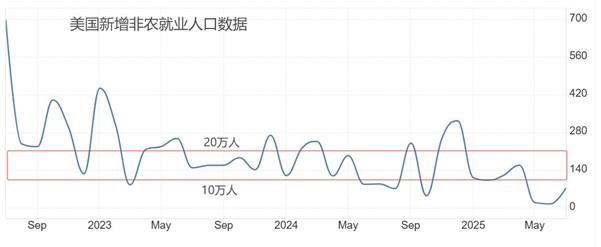

This Friday at 20:30, the U.S. Department of Labor will release the U.S. non-farm employment report in August. The most popular data is the new non-farm employment population, with the previous value of 73,000, and the expected value is 75,000, and the expected value is relatively low. Labor market conditions are the most core factor affecting the Federal Reserve's monetary policy at this stage. Once the number of new non-farm employment drops severely or the unemployment rate rises sharply, it will lead to the Federal Reserve starting to cut interest rates early, and the US index will suffer a serious impact. According to experience, the non-agricultural employment population data of more than 200,000 people will boost the US index, and the non-agricultural employment population of 100,000 to 200,000 is weak in boosting the US index. If the non-farm employment population falls below 100,000, the U.S. dollar index will usually be affected by negative factors regardless of whether the latest value is higher than the previous value and expected value. At 20:15 this Thursday, the US ADP small non-farm data will be released, with the previous value of 104,000 people and the expected value of 68,000 people. The expected value has dropped significantly www.xmniubi.compared with the previous value, which means that the large non-farm data on Friday may be very unoptimistic. However, the three major U.S. stock indexes all showed a big rise in August and made a recordA record high. The stock market is a forward-looking indicator of the labor market. When the stock market rises sharply, the labor market has the possibility of a better future.

▲XM chart

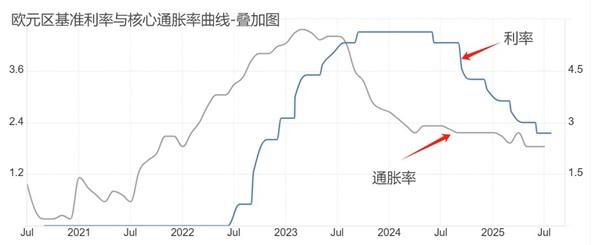

This Tuesday at 17:00, the European Statistics Office will announce the initial value of the euro zone's August CPI annual rate, with the previous value of 2%, and the expected value remained the same; the initial value of the euro zone's core CPI annual rate was announced at the same time, with the previous value of 2.3%, and the expected value was 2.2%. Central banks in various countries generally regard the inflation rate of 2 to 3% as a signal of a healthy economic recovery. The expected values of the euro zone's nominal CPI and core CPI in August are both within this range, which means that the euro zone economy is performing well at this stage. This is also why the ECB dared to announce a suspension of interest rate cuts in its July interest rate resolution. We believe that under the premise that the euro zone CPI data has not deviated significantly from the range of 2~3%, the ECB will keep interest rates unchanged and the euro will continue to be boosted.

▲XM chart

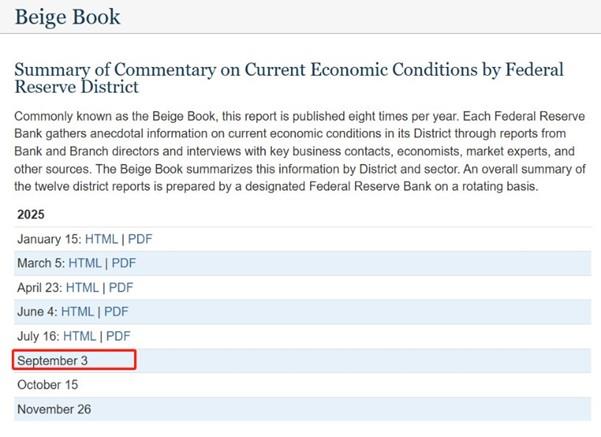

This Thursday at 2:00, the Federal Reserve will announce its sixth Beige Book of the year. Market participants hope to find clues about the direction of the US macroeconomic and the time when the Federal Reserve restarts interest rate cuts. Since the writing format of each brown book is basically the same, we can find changes in the Fed's attitude in different texts and numerical expressions of the old and new brown books. In the July Beige Book, mentioned: Five regions reported slight or moderate growth, with activity flat in the five regions and activity slightly declined in the remaining two regions. If more than five regions reporting economic growth and less than two regions declining economic activity in the Beige Book released this week, the US macroeconomic performance is good and the US dollar index will be boosted.

▲XM chart

This Wednesday at 15:30, ECB President Lagarde will deliver an opening speech at the ESRB annual meeting in Frankfurt, Germany, focusing on his views on the path of macroeconomic and monetary policy. The full name of ESRB is European SystemicRiskBoard, which is literally translated as the European Systemic Risk www.xmniubi.committee. This conference is the 9th Annual Meeting of ESRB, with the theme of "The Impact of the Next 10 Years", which lasts for a day. If Lagarde publishes the US tariff policy, the ECB's monetary policy, and the EU's policy toward Ukraine at this meeting, it may have a significant impact on the euro exchange rate.

XM risk warning, disclaimer, special statement: The market is risky, so be cautious when investing. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not regard this report as the sole reference. At different times,Analysts' opinions may change and updates will not be notified separately.

The above content is all about "[XM Forex Official Website]: Big non-agricultural superimposed brown paper, the US dollar index may face sharp fluctuations this week". It was carefully www.xmniubi.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Life in the present, don’t waste your current life in missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here