Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Forex】--USD/JPY Forecast: Rebounds from 150 Support

- 【XM Market Analysis】--Nasdaq Forecast: Awaits CPI Numbers

- 【XM Decision Analysis】--EUR/USD Forex Signal: Falling Wedge Points to a Rebound

- 【XM Decision Analysis】--BTC/USD Forex Signal: Bitcoin Forms a Head and Shoulders

- 【XM Market Analysis】--S&P 500 Forecast: Threatening a Major Breakout

market news

The moonline breaks the triangle, and the gold, September and October continue to be more

Wonderful introduction:

A clean and honest man is the happiness of honest people, a prosperous business is the happiness of businessmen, a punishment of evil and traitors is the happiness of chivalrous men, a good character and academic performance is the happiness of students, aiding the poor and helping the poor is the happiness of good people, and planting in spring and harvesting in autumn is the happiness of farmers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: The monthly line breaks the triangle, and the gold, September and October continues to be more." Hope it will be helpful to you! The original content is as follows:

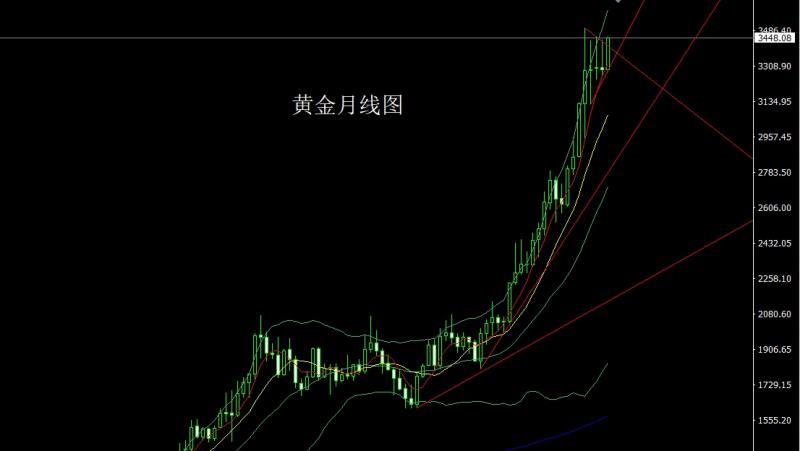

Last week, the gold market www.xmniubi.completed the final structure of August. Let's first review the monthly line. At the beginning of the month, the market opened at 3290.2 and then slightly fell back to the 3281 position. After the market began to rise strongly. In the last week, the triangle broke through and reached the upper track and reached the highest position of 3454.3, and the market was under pressure. After the monthly line finally closed at 3348, the monthly line closed with a saturated large positive line with a lower shadow line slightly longer than the upper shadow line. After this pattern ended, the monthly line effectively broke the pressure. The September market had technical and fundamental demand that hit a historical high.

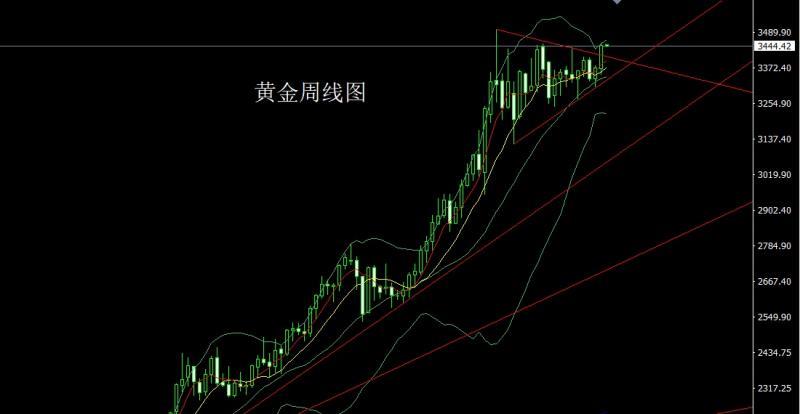

Last week, the gold market opened at the 3371.2 position at the beginning of the week, and the market fell first. The weekly line was at the lowest point of 3350.8 and then the market fluctuated strongly. On Thursday, it effectively broke the upper track of this round of triangle consolidation and continued the pull-up process on Friday. The weekly line reached the highest point of 3454.3 position and the market consolidated. After the weekly line finally closed at the 3348 position, the weekly line was a big sun with a long lower shadow line. After the end of this pattern, there is a demand for long this week. At the point, the long positions of 3325 and 3322 below are held at 3350. Last week, the long positions of 3368-3370 and 3377 and 3385 are held at 3389. Today, 3437 is conservative and 3425 is held at 3421. The target is 3450 and 3455. If the position is broken, the space above opens to 34.62 and 3473 and 3485 and 3500 all-time highs pressure.

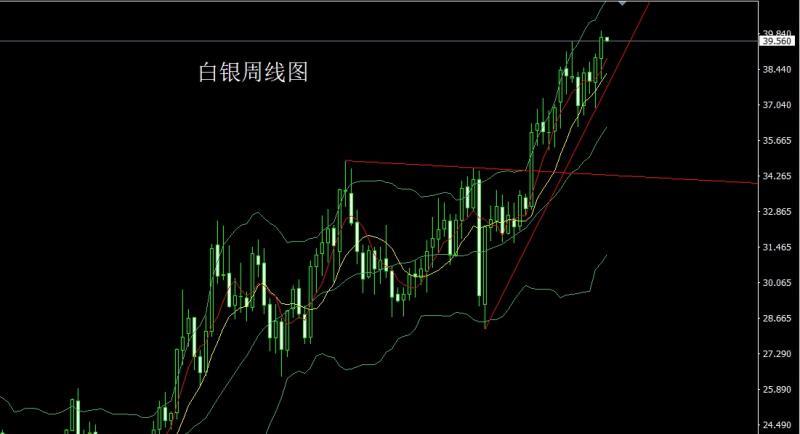

The silver market opened at 38.869 last week and then the market fell first. The weekly line was at the lowest point of 38.063 and then the market rose strongly. The weekly line reached the highest point of 39.961 and then the market consolidated. The weekly line finally closed at 39.687 and then closed with a medium-sung line with a very long lower shadow line. After this pattern ended, the market fell back this week and continued to be long. At the point, the long position of 37.8 below reduced the position and then held at 38.3. Last Friday, the stop loss followed by the 39-38.8 position reduction, and today the 39-25 position reduction was 39.05. The target was 39.65 and 39.95 and 40.2 and 40.5-40.7.

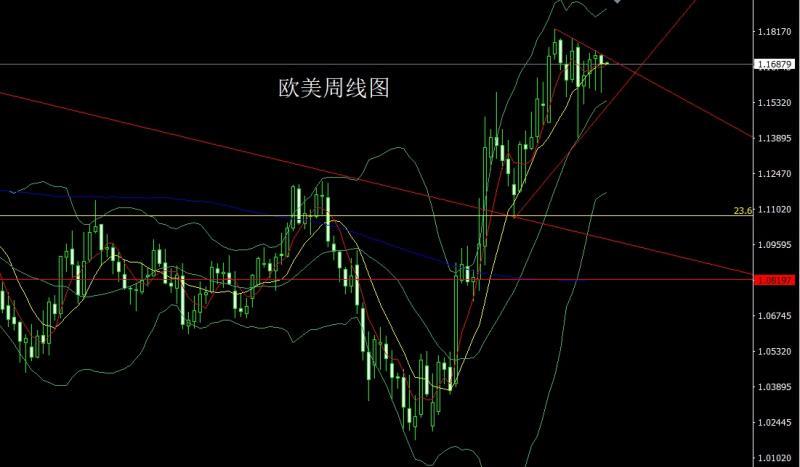

The European and American markets opened at 1.17203 last week and the market rose slightly, and then the market fell strongly. The weekly line was at the lowest point of 1.15730 and then the market rose at the end of the trading session. After the weekly line finally closed at 1.16863, the weekly line ended with a hammer head with a very long lower shadow line. After this pattern ended, the market continued to be long this week. At the point, the stop loss of 1.16600 degrees today was 1.16400, the target was 1.16850 and 1.17000 and 1.17300, and the break was 1.7550 and 1.17800.

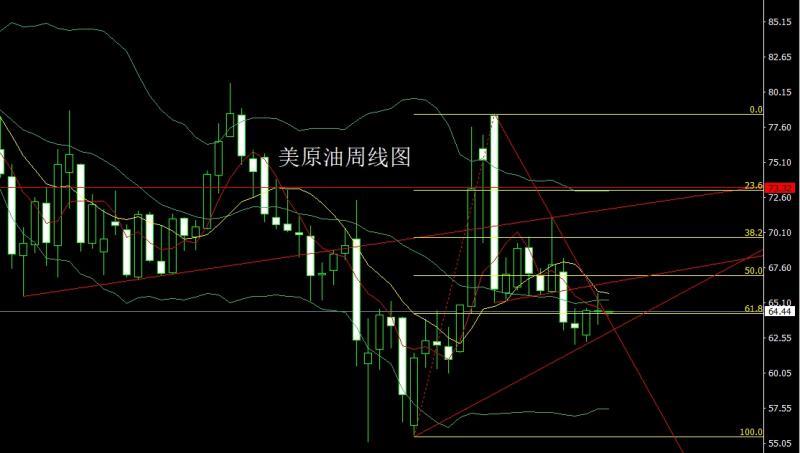

The U.S. crude oil market opened at 64.44 last week and then the market rose first. The weekly line reached the highest position of 65.77 and then fell under pressure. The weekly line was at the lowest position of 63.51 and then rose. After the weekly line finally closed at 64.5, the weekly line closed with a long-leg cross star pattern with an upper shadow slightly longer than the lower shadow. After this pattern ended, the short stop loss of 65.5 this week is 64 and 63.5.

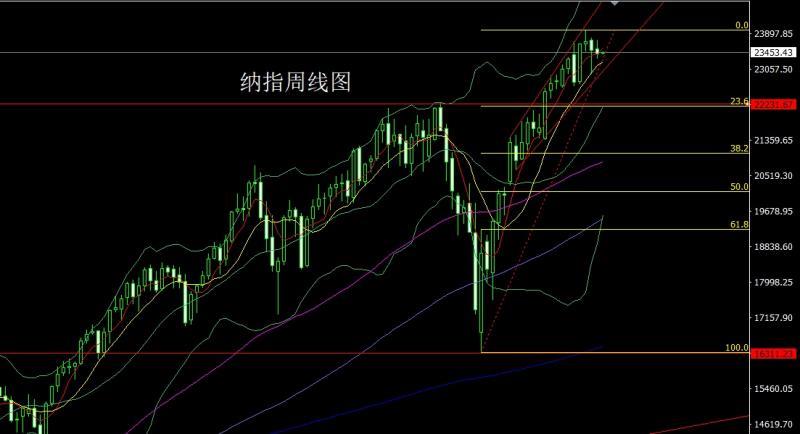

The Nasdaq market opened at 23526.13 last week and then the market fell first. The market fluctuated strongly. The weekly line reached the highest point of 23745.37 and then fell back at the end of the market. After the weekly line finally closed at 23405.06, the weekly line ended with a long upper shadow line in the inverted hammer head pattern. After this pattern ended, the short stop loss of 23610 this week is 23670. The target below is 23350 and 23300, and the break below is 23250 and 23250.23200.

Brands, fundamentals last week The US President took action against Fed insiders and announced the removal of Fed Director Cook. Cook's lawyers said there is no legal basis for the move, and Cook will not resign and will continue to perform his duties. This is the first time in the Fed's 111-year history that the president fired a director. This incident also turbulent the Federal Reserve's policy and personnel. Data this week showed that the U.S. GDP in the second quarter was revised up from 3% to 3.3%, and net exports contributed nearly 5 percentage points, setting a record high. Total domestic revenue (GDI) soared to 4.8% from 0.2% in the first quarter. Meanwhile, the number of initial jobless claims fell to 229,000 last week, lower than expected, showing labor market resilience. Although www.xmniubi.companies have reduced recruitment, the scale of layoffs is not large. Previously, Powell said that the downside risk of the job market increased. Data on Friday showed that the U.S. PCE price index showed a slight increase in inflation in July, with the core PCE inflation rate reaching 2.9%, the highest since February this year. Despite this, the market still expects the Fed to cut interest rates in September. Consumer spending grew by 0.3%, indicating that the economy has some resilience. However, the widening trade deficit may drag down economic growth in the third quarter. The market focus has turned to the non-agricultural data to be released next week. Gold and silver took advantage of the trend to rise, while the US index fell. The fundamentals of this week are still important, focusing on the final value of the euro zone's August manufacturing PMI at 16:00 on Monday and the final value of the UK's August manufacturing PMI at 16:30 on Monday. The U.S. Labor Day market closed on the same day. On Tuesday, we will pay attention to the initial value of the Eurozone August CPI annual rate at 17:00. At night, we will see the final value of the US S&P Global Manufacturing PMI in August at 21:54, and at night, we will see the final value of the US August ISM Manufacturing PMI in August at 22:00 and the monthly rate of construction expenditure in July at 22:00. On Wednesday, we paid attention to the morning when Tiananmen Square held a grand military parade. European Central Bank President Lagarde delivered a speech at 15:00 pm. At night, the Bank of England monetary policy makers attended the parliamentary hearing at 21:15. Look at the 22:00 US July JOLTs job openings and US July factory order monthly rates. On Thursday, the Federal Reserve announced the Beige Book of Economic Conditions at 2:00 a.m. At night, we will see the number of ADP jobs in the United States in August at 20:15. Look at the number of initial unemployment claims and the U.S. trade accounts for July from 20:30 to the week of August 30. Look at the final value of the US S&P Global Services PMI in August at 21:45 later. Then look at the US August ISM Non-Manufacturing PMI at 22:00. On Friday, we focused on the EIA crude oil inventories from the U.S. to August 29 week and the EIA Cushing crude oil inventories from the U.S. to August 29 week and the EIA strategic oil reserve inventories from the U.S. to August 29 week. At night, we will see the revised annual GDP rate of the euro zone in the second quarter at 17:00 and the final quarterly rate of employment in the euro zone in the second quarter. During the US session, the main focus was on the unemployment rate in August of the United States at 20:30 and the non-farm employment population after the seasonal adjustment in August. This round is expected to be 4.3% and 78,000, while the previous value is 4.2% and 73,000.

Operation, Gold: The stop loss after the reduction of positions in the 3325 and 3322 below is held at 3350, and the stop loss after the reduction of positions in the 3368-3370 last week is held at 3389, and the 3437 long and 3425 long and 3421 today is held at 3450 and 3455. If the target is 3462 and 3473 and 3485 and 3500, if the above space opens to look at the historical high pressure.

Silver: After reducing the position at 37.8 below, stop loss will follow up at 38.3. Last Friday, the stop loss followed by 39.25, 39.05, the target is 39.65 and 39.95 and 40.2 and 40.5-40.7.

Europe and the United States: 1.16600-degree stop loss today is 1.16400, the target is 1.16850 and 1.17000 and 1.17300, the target is 1.7550 and 1.17800.

US crude oil: 6 this week 4.9 Short stop loss 65.5 The target below looks at 64 and 63.5.

Nasdaq Index: 23610 short stop loss 23670 this week, the target below looks at 23350 and 23300, and the target below looks at 23250 and 23200.

The above content is all about "[XM Foreign Exchange Official Website]: The monthly line breaks the triangle, and the gold, September and October continues to be long", which is carefully www.xmniubi.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here