Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Forex】--EUR/USD Analysis: Preparing for Further Losses

- 【XM Decision Analysis】--USD/CHF Forecast: Holds Firm at 0.90 Support

- 【XM Forex】--BTC/USD Forecast: Stabilizes After Selloff, Eyes $110K

- 【XM Forex】--EUR/USD Forecast: Euro Gives Up Early Gains on Friday

- 【XM Market Review】--EUR/USD Analysis: Bearish Outlook Remains

market analysis

The Federal Reserve's turmoil has revived, and the short-term trend analysis of spot gold, silver, crude oil and foreign exchange on August 29

Wonderful Introduction:

Love sometimes does not require the promise of vows, but she must need meticulous care and greetings; sometimes she does not need the tragic spirit of Liang Zhu turning into a butterfly, but she must need the tacit understanding and www.xmniubi.companionship with each other; sometimes she does not need the follower of male and female followers, but she must need the support and understanding of each other.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: The Federal Reserve's storm is on again, and the short-term trend analysis of spot gold, silver, crude oil and foreign exchange on August 29." Hope it will be helpful to you! The original content is as follows:

Global Market Review

1. European and American market trends

The three major U.S. stock index futures fell, Dow futures fell 0.33%, S&P 500 futures fell 0.30%, and Nasdaq futures fell 0.51%. The German DAX index fell 0.44%, the UK FTSE 100 index fell 0.24%, the French CAC40 index fell 0.42%, and the European Stoke 50 index fell 0.53%.

2. Market news interpretation

The Federal Reserve has resurfaced, and the game between the US dollar is escalating

⑴ Before the release of the core PCE inflation data on Friday, the US dollar strengthened slightly, mainly supported by the upward trend of US Treasury bond yields. ⑵ Data shows that the US dollar index rose 0.16%, while major currencies such as the euro, the yen and the pound all fell to varying degrees against the US dollar. ⑶ The market is closely monitoring the core PCE price index of the United States in July, and is predicting that the year-on-year growth rate will rise to 2.9% from 2.8% in June. ⑷ In the U.S. Treasury market, yields rose across the board, and the yield curve was slightly steeper, reflecting investors' concerns about the Fed's personnel changes and the upcoming inflation data. ⑸ The pound fell the most significantly against the US dollar, mainly affected by the UK's proposal to impose new taxes on bank reserves. ⑹ Although the US dollar faces technical resistance and Trump's tariff remarks may have an impact on the US dollar's trend, the market is still waiting for guidance on key data.

Germany's inflation rate rose to 2.2% in July to a five-month high

⑴Germany's initial inflation rate in July 2025 year-on-yearIt rose to 2.2% (the previous value of 2%), higher than the market expectations of 2.1%. ⑵This is the highest level since March, and it was flat at the 2% target of the ECB in the previous two months. ⑶ www.xmniubi.commodity inflation rose to 1.3% (formerly 1%): Food prices rose (2.5% vs 2.2%), and energy decline narrowed (-2.4% vs -3.4%). ⑷ Service inflation remained stable at 3.1%, and core inflation remained at 2.7%. ⑸From month-on-month, the price rose by 0.1%.

Trump withdraws Secret Service Protection for Kamala Harris

According to www.xmniubi.comN's report on Friday, US President Trump has decided to cancel Secret Service Protection for former vice president and Democratic rival Kamala Harris in 2024 election. According to customary practice, the US vice president can enjoy six months of Secret Service protection after leaving office, and Harris's security period was extended to one year during Biden's presidency.

PCE and power game dual impact, the US Treasury yield curve steepened

⑴ Before the key PCE inflation data and the hearing of Fed Director Cook, SOFR futures opened and fell, especially forward contracts, showing cautious market sentiment. ⑵ Data shows that the yield curve of the treasury bonds rose across the board, with the interest rate spread of 2-year and 30-year treasury bonds widening by 3 basis points, long-term assets led the rise, and the yield curve continued to steeper. ⑶ Although short-term yields remained stable, the yields of 3-year to 30-year Treasury bonds all rose to varying degrees, among which the 30-year Treasury bonds had the largest increase, up 3.2 basis points. ⑷ The market generally believes that the steepening of the yield curve is driven by the remarks of dovish Federal Reserve official Waller and investors' concerns about inflation and changes in the Fed. ⑸ In addition, traders also made profits after the weekly auction, further aggravated market volatility. ⑹ Nevertheless, according to the moving average model, all contracts are still at a "buy" signal, but it is recommended to reduce positions on 2-year, 3-year, 5-year, 7-year, 10-year and 20-year Treasury bonds and increase their long positions on 30-year Treasury bonds.

Worries about oversupply have increased crude oil will face a difficult climb

Surveys show that due to the rise in production of major oil-producing countries, the risk of oversupply and the threat of U.S. tariffs have suppressed demand growth, it is difficult for oil prices to gain too much momentum from the current level this year. A survey of 31 economists and analysts in August predicts that the average Brent crude oil price will be $67.65 per barrel in 2025, basically the same as the July forecast of $67.84. The average global benchmark Brent crude oil price so far this year is about $70. The average U.S. crude oil price is expected to be $64.65, www.xmniubi.compared with the estimated last month at $64.61. "With the latest increase in OPEC+ and weak global demand expectations, the outlook for market overcapacity in 2025 will be even more severe," said Mutaz Altagribi, senior energy economist at the Bank of China. He pointed out that the outlook is still shrouded in "deep uncertainty", especially involving "in-depth uncertainty"," he said.Geopolitical consequences of the U.S. additional tariffs, such as the Iran nuclear deal or Russia's agreement to a ceasefire.

UBS lowered Swiss economic growth expectations for 2026 tariff shocks sparked concerns

UBS Group lowered its forecast for Switzerland's economic growth next year, and expected that the country's economy would suffer lasting impact as long as US President Trump's 39% tariff policy continues to be effective. UBS analysts currently expect GDP to grow by 0.9% in 2026 adjusted for major sports events, lower than the previous 1.2% forecast, according to a report released on Friday. Analysts added that if Switzerland fails to reach an agreement with the United States, economic growth could cut by up to 0.4 percentage points next year. Economists say rising unemployment rates and weak wage growth may exacerbate the slowdown.

Russian President Press Secretary: Putin does not rule out the possibility of meeting Zelensky

On August 29 local time, Russian President Press Secretary Peskov said that Russian President Putin does not rule out the possibility of meeting Zelensky. Peskov also pointed out that Putin believes that any high-level meeting should be fully prepared. Peskov also said that the current negotiation process around Ukraine's conflict resolution is "not active", but Russia remains interested in the negotiations. In addition, for the sake of conflict resolution, all details of the Russian-US leaders' meeting in Alaska were intentionally kept confidential.

Double data storm is www.xmniubi.coming, Canadian stock futures are under cautious pressure

⑴ Canadian major stock index futures fell slightly on Friday, and investors remained cautious before the release of Canada's domestic GDP data and U.S. core inflation data. ⑵ Data shows that Canada's GDP in June is expected to grow by 0.1% month-on-month, but the economy may shrink by 0.6% annually in the second quarter, highlighting the pressure facing the economy. ⑶ Traders expect the Bank of Canada to cut interest rates at least once this year to cope with the slowdown. ⑷ At the same time, the market is closely monitoring the Fed's preferred inflation indicator. CME data shows that the market's expectations for the Fed's 25 basis points cut in September are as high as 85.2%. ⑸ Although Canada's top banks were strong this week and non-performing loan provisions were lower than expected, both oil and gold prices fell slightly on Friday. ⑹The Canadian stock market benchmark index is expected to rise for the fourth consecutive month, but the upcoming data will provide key guidance for the next move of the market.

Green energy explosion, European power market faces downward pressure

⑴ Due to the increase in renewable energy supply, spot electricity prices in Germany and France are expected to be under pressure next Monday. ⑵ Data shows that Germany's wind power generation is expected to increase by 4.5 GW to 12 GW next Monday, and solar power generation will also increase by 1.9 GW to 13.3 GW. ⑶ Although Germany's electricity demand has increased slightly, net electricity imports are expected to cover all time periods. ⑷France, although wind power generation is expected to decrease by 2.9 GW to 8 GW, electricity demand is expected to decrease by 230 MW to 43 GW due to the drop in temperature. ⑸ In addition, a nuclear reactor in France was removed from the line due to planned maintenance., resulting in a decrease of 2 percentage points in nuclear energy availability to 73% of the total capacity. ⑹ Despite the downward pressure on spot prices, the prices of forward power contracts in Germany and France performed in a mixed manner, with the contracts in Germany rising 0.4% this year, while the French contracts in 2026 fell 0.2%.

Eurozone's July consumer inflation expectations remained at 2.6%

⑴The eurozone's median consumer inflation expectations remained at 2.6% in July 2025, the lowest level since February. ⑵ The three-year inflation expectation rose to 2.5% (the previous value of 2.4%), while the five-year inflation expectation remained stable at 2.1% for eight consecutive months. ⑶ The perception and short-term expectations of inflation among low-income groups are still slightly higher than those of high-income groups, and this trend has continued since 2023. ⑷ The inflation perception and expected evolution of each income group are basically synchronized. ⑸ The inflation perception and expectations of young respondents (18-34 years old) are still lower than those of older groups (35-54 years old and 55-70 years old), but the gap narrows www.xmniubi.compared with previous years. ⑹The economic growth expectation deteriorates to -1.2% (formerly value -1%) in the next 12 months, and the unemployment rate expectation rises to 10.6% (formerly value 10.3%).

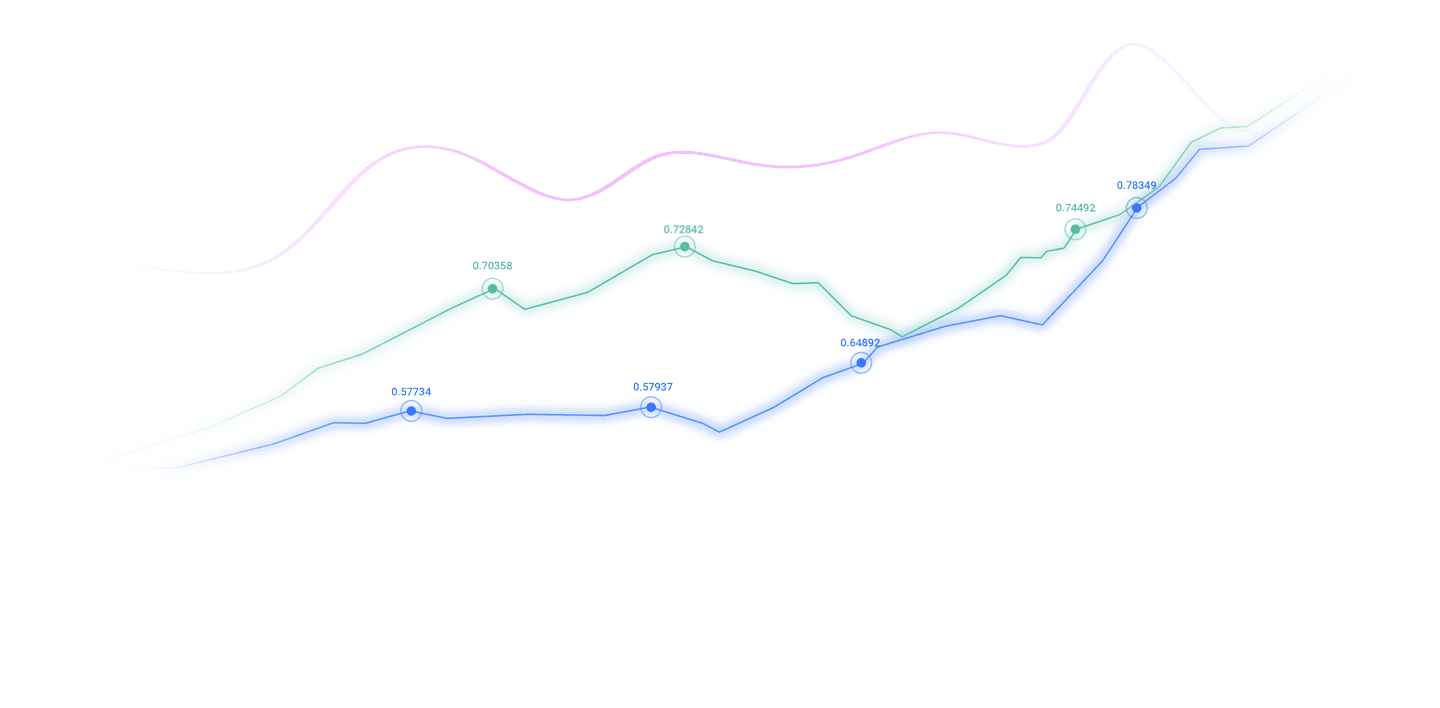

3. Trends of major currency pairs in the New York Stock Exchange before the market

Euro/USD: As of 20:23 Beijing time, the euro/USD fell and is now at 1.1658, a drop of 0.22%. Before New York, the price of (Euro-USD) fell on the last trading day due to negative signals on (RSI), after it successfully got rid of overbought, opening the way for more gains on the near-term basis, while the pair was trying to get bullish momentum that could help it recover and rise again, as positive pressure from trading above the EMA50 continues, with small bullish waves on the short-term basis dominating.

GBP/USD: As of 20:23 Beijing time, GBP/USD fell and is now at 1.3456, a drop of 0.42%. Before the New York Stock Exchange, after the (GBPUSD) price reached overbought levels, it fell on the last trading day in the event of negative signals on the (RSI) to get rid of this overbought state, gathering positive forces that could help it recover and rise again in the case of a short-term bullish correction trend dominant, and trading along a slash, leveraging the dynamic support it represents on the exchange above the EMA50 to form a positive barrier to prevent the pair from having a positive position in the near term.

Spot gold: As of 20:23 Beijing time, spot gold fell, now at 3409.44, a drop of 0.22%. Before the New York Stock Exchange, the (gold) price fell on the last trading day, trying to collect the gains of its previous rise and obtain potentially helping it recover andThe positive momentum of rising again, the price successfully escaped from the overbought state of (RSI), with the main bullish trend dominating in the short term and trading along a slash line, where positive pressure from trading above the EMA50 continues to exist, strengthening the stability of the positive scenario.

Spot silver: As of 20:23 Beijing time, spot silver fell, now at 38.769, a drop of 0.65%. Before New York, the (silver) price fell on the last trading day, trying to find a rising low as it bases on helping it get the bullish momentum needed to recover and rise again, and successfully got rid of the apparent overbought state of (RSI), opening the way for more gains, with the main bullish trend dominating and trading along the main and secondary support lines of the track.

Crude oil market: As of 20:23 Beijing time, U.S. oil fell, now at 64.350, a drop of 0.37%. Before the New York Stock Exchange, the (crude oil) price rose on the last trading day, and in the recovery attempt, leveraging its dynamic support represented by the exchange above the EMA50, dominated by the short-term bullish correction trend, and trading along the supportive slash, on the other hand, we noticed negative signals (RSI) after reaching overbought levels, which could temporarily slow the upcoming rally.

4. Institutional View

Deutsche Bank: CPI data of various countries in the euro zone may affect the trend of euro zone government bonds

France, Spain, Italy and Germany will announce initial inflation values on Friday, which may affect the trend of euro zone government bonds. "National inflation data released by several euro zone countries may indicate that the euro zone HICP is expected to have downside potential." If the 10-year German Treasury bond yield rises above 2.70%, the www.xmniubi.commerzbank Research Department recommends going long strategically.

Institution: Global smartwatch shipments increased by 8% year-on-year in the second quarter of 2025

Market research agency CounterpointResearch released a report saying that global smartwatch shipments increased by 8% year-on-year in the second quarter of 2025, marking a rebound in the market after five consecutive quarters of decline. The agency pointed out two major reasons for promoting the recovery of global smartwatch business. One is the steady growth of global consumers' demand for smartwatches, and the other is the boost of the Chinese market led by brands such as Huawei, Xiaomi and Xiaotiancai.

The above content is about "[XM Foreign Exchange Market Analysis]: The Federal Reserve's turmoil againStarting from the August 29th, the entire content of the short-term trend analysis of spot gold, silver, crude oil and foreign exchange" was carefully www.xmniubi.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thank you for your support!

Living in the present, don’t waste your current life in missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here